|

Dear [Colleague]:

Despite the continuing gale force winds in the global economy, the electronics manufacturing industry continues to focus on the future.

Against the backdrop of an impending U.S. government shutdown, a roomful of military and industrial experts gathered to discuss the progress they are making in reshoring defense electronics capabilities.

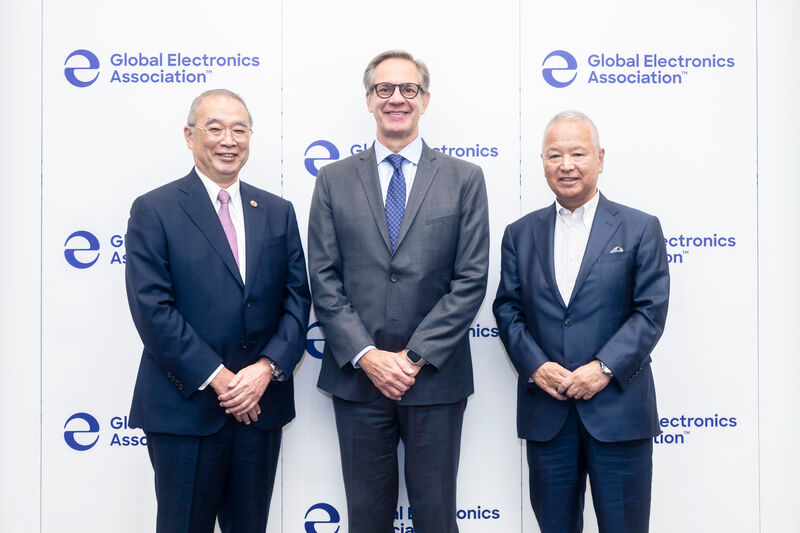

In Japan, the Global Electronics Association hosted its first-ever press seminar there, focusing on the future of electronics.

And in Europe, we are commenting on the future of the EC’s sustainability framework and its rules for substances of concern, signaling a push for practical, future-proof policies that protect the environment without adding duplicative burdens to manufacturers.

Don’t miss our 5-minute survey on H-1B high-skilled visa changes. We welcome any questions or input.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- U.S. Onshoring Workshop Highlights Industry Momentum

QUOTE OF THE WEEK

- USPAE’s Jim Will on the Urgency of a Trusted Electronics Supply Chain

UNITED STATES

- U.S. Government Shutdown Brings Fresh Uncertainties

- H-1B Visa Overhaul: What Do You Think?

- U.S. Tariffs Heavy Trucks, Launches New Investigations

EUROPE

- New Advanced Packaging Video Highlights European Industry Needs

ASIA

- Vietnam Electronics Growth Endures Despite U.S. Tariff Pressures

MEXICO

- Tariffs, Nearshoring, and New Investments Shape Mexico’s Electronics Industry

ENVIRONMENT AND SUSTAINABILITY

- Industry Groups Push for Pragmatic Rules on Substances of Concern

- Association Recommends “Fit-for-Purpose” Sustainability Framework

- Global Electronics Association to Join Sustainability Week Europe

- EU Deforestation Regulation Timeline in Flux

- U.S. EPA Opens Consultations Under TSCA

OTHER HEADLINES IN THE NEWS

- Los Angeles Times | H-1B visa rule revamp clashes with California chip manufacturing

- Yahoo! Finance | Taiwan says 1:1 chip split did not come up in recent US trade talks

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

H-1B Visa Overhaul Sends Shockwaves Through Tech and Electronics: U.S. President Donald U.S. Onshoring Workshop Highlights Industry Momentum: Advanced packaging and microelectronics play a crucial role in U.S. national and economic security, and reshoring momentum is building. That was the upshot of a packed, three-day Onshoring Workshop last week in Arlington, Virginia, co-hosted by the International Microelectronics Assembly and Packaging Society (IMAPS) and Global Electronics Association. According to a LinkedIn post by the U.S. Partnership for Assured Electronics (USPAE), a standing-room-only crowd heard leaders from the Department of Defense and industry describe the progress they are making on reshoring key capabilities. Highlights included DARPA updates on the 3DHI and Minitherms programs with hardware demonstrations tackling power and heat challenges; industry briefings on advanced packaging readiness available today; and “Microelectronics Commons Hubs” that are outlining pathways to move projects from “lab to fab.” With the next Commons Call for Projects expected this month, momentum continues to build. USPAE says, “Workshops like this are a reminder: building assured domestic microelectronics capabilities isn’t optional; it’s essential.” Contact: James Will

|

|

“Tablets aren’t just ‘consumer electronics’ anymore. Today’s tablets are integrated into avionics systems, missile defense networks, and secure logistics for our military. And that makes them a target. … And it doesn’t atop at defense. Tablets are in hospitals, banks, utility systems, and transportation hubs. If adversaries cut off supply or compromised these devices the fallout wouldn't just hit our military. It would affect every American.”

— Jim Will, Executive Director of U.S. Partnership for Assured Electronics (USPAE), highlighting the urgency of a trusted, resilient supply chain for electronics in a new LinkedIn blog post.

|

U.S. Government Shutdown Brings Fresh Uncertainties: The U.S. government entered a partial shutdown after lawmakers failed to reach agreement on spending levels for Fiscal 2026, which started on October 1. According to CNBC, hundreds of thousands of federal employees have been furloughed, with many government services suspended or reduced, while operations deemed “essential” continue. Federal News Network is among the many outlets publishing summaries of federal agency cutbacks and suspended activities. The Economic Times reported that U.S. Small Business Administration loans have halted, limiting access to capital for companies seeking to expand or invest.

Meanwhile, the Trump administration is continuing to roll out tariffs and trade measures. Yahoo! Finance reported that ten active Section 232 investigations are still advancing, meaning potential duties on critical goods such as minerals and semiconductors could proceed on existing timelines.

For the electronics manufacturing industry, the shutdown raises concerns about delayed reporting of economic data, financing constraints, and uncertainties in trade policy – all factors that could ripple across supply chains in the weeks ahead. Contact: Chris Mitchell

H-1B Visa Overhaul: What Do You Think? The Trump administration recently announced dramatic changes in the H-1B high-skilled worker visa program, and the Global Electronics Association needs to know your thoughts.

According to Forbes, the Trump executive order imposes a $100,000 annual fee, raises prevailing wage requirements, and establishes a national interest exception that allows the Department of Homeland Security to waive the fee in certain cases. Devdiscourse reported that the administration’s stated goal is to protect U.S. jobs and wages, but for tech companies, the policy raises concerns about access to skilled labor, cost burdens, and potential offshoring of critical roles.

The Global Electronics Association invites you to participate in a 5-minute survey on the impact of these changes; your input will shape industry advocacy. Contact: Chris Mitchell

U.S. Tariffs Heavy Trucks, Launches New Investigations: Last week, U.S. President Donald Trump announced a 25% tariff on heavy trucks imported into the United States.

As CNN reported, many foreign-built trucks are manufactured in Mexico and imported tariff-free under the US-Mexico-Canada Agreement, as long as roughly two-thirds of the truck’s parts were made in North America. If there is no exemption for those trucks, then Mexican manufacturers and North American suppliers may be the ones most severely affected by these tariffs.

Meanwhile, the U.S. Commerce Department launched new national security investigations into imports of medical items, robotics, and industrial machinery. According to Reuters, the probes, which opened on September 2 but were not previously disclosed, could form the basis for additional tariffs on a wide range of goods.

These inquiries add to a growing list of Section 232 investigations already underway into sectors such as semiconductors, critical minerals, and wind turbines. For electronics manufacturers, the investigations highlight how national security considerations are increasingly shaping U.S. trade and tariff policy. Contact: Chris Mitchell

|

New Advanced Packaging Video Highlights European Industry Needs: The Global Electronics Association’s Europe team recently released a new video highlighting why greater support of advanced packaging is essential for boosting innovation, supporting supply chain resilience, and anchoring high-value production in Europe. The video shows how advanced packaging technologies bridge the gap between chip design and system integration, creating opportunities for Europe to lead in areas such as automotive, industrial, and next-generation computing applications. It also emphasizes the importance of coordinated public and private investment to build a globally competitive ecosystem. Members are encouraged to view and share the video as a resource for understanding Europe’s evolving strategy on semiconductors and electronics. Contact: Alison James

|

Vietnam Electronics Growth Endures Despite U.S. Tariff Pressures: Vietnam is among the Asian economies hardest hit by new U.S. tariffs, with electronics, textiles, and footwear identified as particularly vulnerable sectors, according to the Asia News Network. Despite these pressures, Vietnam’s electronics industry continues to expand. Electronics now account for the largest share of the country’s trade with China, making up more than half of bilateral trade flows, as reported by Vietnam News. This underscores the sector’s importance to both Vietnam’s economy and its regional trade relationships.

At the same time, Vietnam is moving to strengthen strategic partnerships to diversify its technology base. A new Memorandum of Understanding signed with the Korea Fabless Industry Association will expand cooperation in artificial intelligence and semiconductors through joint R&D, training programs, and technology transfer, according to Vietnam News. These developments illustrate how Vietnam’s electronics sector is maintaining momentum even amid tariff headwinds, reinforcing its role as a key link in global supply chains. Contact: Gaurab Majumdar

|

Tariffs, Nearshoring, and New Investments Shape Mexico’s Electronics Industry: Mexico’s electronics industry is entering a period of both pressure and opportunity as trade, investment, and policy trends converge. President Claudia Sheinbaum has proposed tariffs of 10% to 50% on 1,371 import categories from countries without trade agreements with Mexico, including electronics. According to Mexico News Daily, the measure is designed to shield local industries such as automotive and manufacturing but could also raise costs for electronics inputs, creating new considerations for supply chain strategies.

At the same time, Mexico’s exports to the United States are surging. Between January and July, electronics and computer exports rose 49% year-on-year, capturing nearly a quarter of the share lost by China under U.S. tariffs, as reported by Mexico Business News. This reflects a clear shift toward nearshoring, with Mexico strengthening its role as a preferred hub for resilient supply chains serving North American markets.

Foreign investment is also accelerating. In the first five months of 2025, Guanajuato secured 22 new projects worth $2.2 billion, generating more than 9,400 jobs, according to Mexico Industry. The region’s momentum underscores how industrial clusters are attracting capital into automotive, electronics, and advanced manufacturing sectors.

Together, these developments illustrate how tariffs, nearshoring, and investment are reshaping Mexico’s position in global electronics production. The Global Electronics Association Mexico will continue to monitor policy proposals and advocate for competitiveness while helping members seize emerging opportunities. Contact: Lorena Villanueva

|

Industry Groups Push for Pragmatic Rules on Substances of Concern: The Global Electronics Association has joined with other leading industry groups in urging European policymakers to adopt a harmonized and workable approach to the “Substances of Concern” concept across sustainability policies. According to the joint letter, submitted as part of the European Commission’s consultation on simplifying administrative burdens in environmental legislation, a coherent framework is needed to avoid duplication while ensuring both sustainability and competitiveness. The consultation closed on September 10, and industry groups emphasized that pragmatic, non-duplicative rules will be critical to supporting innovation and compliance across the electronics industry. Contact: Diana Radovan

Association Recommends “Fit-for-Purpose” Sustainability Framework: The Global Electronics Association has released a new position on the European Union’s sustainability reporting framework, providing both voting recommendations on amendments proposed by the European Parliament’s Committee on Legal Affairs (JURI) and broader recommendations to the Parliament, Commission, and Council ahead of trialogue negotiations. For the electronics industry and its complex supply chain, the Association emphasizes that Tier-1 due diligence obligations are not only necessary but the only realistic approach. The position also supports adoption of sector-specific standards by 2030; stronger alignment across different sustainability reporting policies; and harmonization of implementation among EU Member States to prevent further regulatory fragmentation. Contact: Diana Radovan

Global Electronics Association to Join Sustainability Week Europe: As Europe navigates economic headwinds, companies in the electronics sector face increasing pressures to balance near-term profit challenges with long-term sustainability goals. Governments are reallocating green funds and tightening regulations, reshaping the competitive landscape for manufacturers.

Sustainability Week Europe, taking place in Amsterdam on October 6–7, will bring together more than 500 senior executives, policymakers, investors, and innovators to address these questions. According to organizers, discussions will focus on the future flow of sustainability investments, the role of transparency and ESG reporting, Europe’s competitiveness in green technologies, and the trade-offs between short-term gains and long-term resilience. Dr. Diana Radovan, the Global Electronics Association’s Director of Sustainability Policy, will attend the conference and report back. Members attending the event are encouraged to connect with her. Contact: Diana Radovan

EU Deforestation Regulation Timeline in Flux: Most electronics companies are expected to fall under the scope of the EU Deforestation Regulation depending on whether they operate in high-deforestation-risk regions and which natural resources they use. But now, based on a letter from Environmental Commissioner Jessika Roswall to the Chair of the Environmental Council, the implementation of EUDR might be facing a one-year postponement, to the end of 2026. Roswall says the IT systems required for reporting and compliance are not yet fully mature. The timeline for adoption remains unclear, and companies should continue preparing for compliance while monitoring for changes. The Global Electronics Association will track developments and update members as new information becomes available. Contact: Diana Radovan

U.S. EPA Opens Consultations Under TSCA: The U.S. Environmental Protection Agency (EPA) has released a draft risk evaluation for D4 (octamethylcyclotetrasiloxane) under the Toxic Substances Control Act (TSCA). According to the agency, the preliminary findings indicate that D4 poses an unreasonable risk to human health and the environment under certain conditions of use. D4, a cyclic silicone compound, is widely used in electronics, including in semiconductor manufacturing, where it often remains embedded in components and does not emit during use. The substance is already classified as a “substance of very high concern” (SVHC) by the European Chemicals Agency (ECHA) and is banned in EU personal care products due to persistence, bioaccumulation, and toxicity. EPA will accept public comments on the draft evaluation through November 17 via this docket, and it will convene a series of public meetings in the coming months.

|

|

A new video from the Global Electronics Association highlights a shift toward more advanced PCBs. |

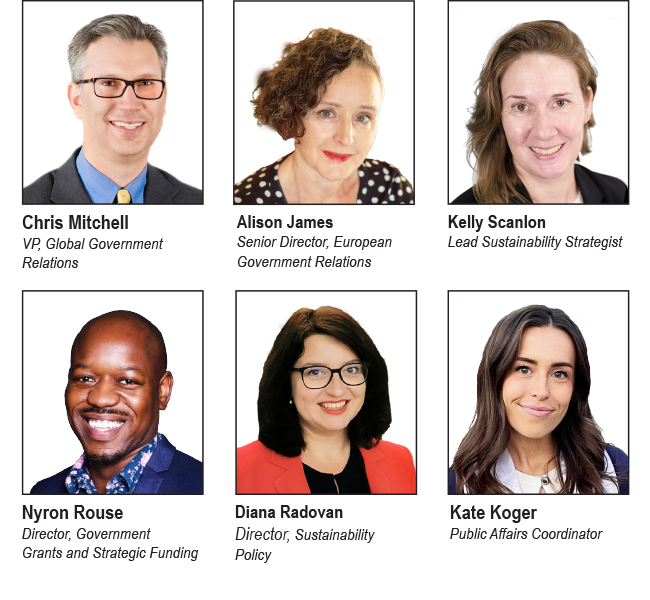

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |