|

Dear [Colleague]:

This week brings still more government policy developments shaping the global electronics industry.

In the United States, the prospect of a government shutdown is creating new uncertainties; high-skilled visa changes are sowing confusion for companies that rely on them; heavy truck imports are now tariffed; and fresh national security investigations are examining imports of robotics and industrial machinery.

Across Europe, advanced packaging is in the spotlight with a new video by our team; while regulators are weighing sustainability priorities and timelines. In Asia and Latin America, electronics sectors are continuing to grow even as U.S. tariffs create new pressures.

Sustainability also remains a defining challenge, with industry leaders gathering in Amsterdam for Sustainability Week Europe, and with U.S. and EU agencies opening new consultations on environmental risks and chemical regulations.

Keep reading for your weekly five-minute update, and as always, reach out with any questions or input.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- H-1B Visa Overhaul Sends Shockwaves Through Tech and Electronics

QUOTE OF THE WEEK

- European PCB Crisis Discussed at IPC Day Paris

UNITED STATES

- U.S. Tariffs Heavy Trucks, Launches New Investigations

- U.S. Senate Defense Bill Draft Includes Rules on Advanced Chips

EUROPE

- New Advanced Packaging Video Highlights European Industry

- New Report on Tariffs and Europe’s Electronics Industry

ASIA

- Vietnam’s Electronics Growth Endures Despite U.S. Tariff Pressures

- Thailand Seeks to Expand Semiconductor Role with U.S. Roadshow

MEXICO

- Tariffs, Nearshoring, and Investments Shape Mexico’s Electronics Industry

ENVIRONMENT AND SUSTAINABILITY

- Association Recommends “Fit-for-Purpose” Sustainability Framework

- Global Electronics Association to Join Sustainability Week Europe

- EU Deforestation Regulation Timeline in Flux

- U.S. EPA Opens Consultations Under TSCA

- U.S. EPA Advances Proposal to Ease PFAS Reporting Mandates

- European Chemicals Agency Provides Updates on PFAS Plans

OTHER HEADLINES IN THE NEWS

- CNBC | India is betting $18 billion to build a chip powerhouse. Here’s what it means

- Yahoo! Finance | Taiwan Just Pulled Its Chip Card on South Africa--And Beijing Is Watching

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

H-1B Visa Overhaul Sends Shockwaves Through Tech and Electronics: U.S. President Donald Trump signed a proclamation late last Friday imposing a $100,000 fee on all new H-1B visa petitions for foreign nationals outside the United States, in one of the most dramatic changes to the program in decades. According to Forbes, the order also raises prevailing wage requirements and establishes a national interest exception that allows the Department of Homeland Security to waive the fee in certain cases. The policy took effect immediately and is set to last for 12 months unless extended. Industry groups such as Nasscom warned the measure could harm U.S. competitiveness, while analysts noted the sudden cost increase could be especially difficult for startups and mid-sized firms.

Initial confusion led many to believe that existing visa holders would be affected, though clarifications confirmed that renewals are not included. Devdiscourse reported that the administration’s stated goal is to protect U.S. jobs and wages, but the policy has sparked concern across the technology sector. For the electronics industry, the new fee and tighter restrictions raise concerns about access to skilled labor, cost burdens, and potential offshoring of critical roles. The Global Electronics Association will be releasing a survey to member companies on the impact of these changes and invites you to participate in shaping industry feedback. Contact: Chris Mitchell

|

|

“The crisis in Europe’s printed circuit board (PCB) industry remains front and center. Executives stressed the urgent need to rebuild the PCB manufacturing base—especially for defense and critical infrastructure—before it erodes further."

— Chris Mitchell, Vice President of Global Government Relations at the Global Electronics Association, in a LinkedIn post recapping last week’s IPC Day for European EMS companies

|

U.S. Tariffs Heavy Trucks, Launches New Investigations: U.S. President Donald Trump announced a 25% tariff on heavy trucks imported into the United States. As CNN reports, many foreign-built trucks are manufactured in Mexico and imported tariff-free under the US-Mexico-Canada Agreement, as long as roughly two-thirds of the truck’s parts are made in North America. If there is no exemption for those trucks, then Mexican manufacturers and North American suppliers may be the ones most severely affected by these tariffs.

Meanwhile, the U.S. Commerce Department has launched new national security investigations into imports of personal protective equipment, medical items, robotics, and industrial machinery. According to Reuters, the probes, which opened on September 2 but were not previously disclosed, could form the basis for additional tariffs on a wide range of goods. The Commerce Department highlighted particular interest in major exporters such as China, as well as the impact of foreign subsidies and trade practices on U.S. markets.

These inquiries add to a growing list of Section 232 investigations already underway into sectors such as semiconductors, critical minerals, and wind turbines. For electronics manufacturers, the investigations highlight how national security considerations are increasingly shaping U.S. trade and tariff policy. Contact: Chris Mitchell

U.S. Senate Defense Bill Includes Rules on Advanced Chips: Last week, Forbes reported that the U.S. Senate draft of the annual National Defense Authorization Act includes the bipartisan GAIN AI Act, a proposal that would impose new licensing requirements on advanced chips and give American buyers first rights to supplies otherwise destined for countries of concern. Supporters in Congress argue the measure is needed to strengthen national security and safeguard U.S. access to critical technologies. However, industry groups and leading companies have raised concerns that stricter limits could disrupt global supply chains and slow innovation. Expanding licensing rules risks creating bottlenecks that reduce chip availability for downstream industries. For global electronics manufacturers, the developments highlight how regulatory actions could reshape chip availability, trade flows, and investment strategies. For additional perspective, see the Global Electronics Association’s recent international trade flows report. Contact: Chris Mitchell

|

New Advanced Packaging Video Highlights European Industry: The Global Electronics Association’s Europe team recently released a new video highlighting why greater support of advanced packaging is essential for boosting innovation, supporting supply chain resilience, and anchoring high-value production in Europe. The video shows how advanced packaging technologies bridge the gap between chip design and system integration, creating opportunities for Europe to lead in areas such as automotive, industrial, and next-generation computing applications. It also emphasizes the importance of coordinated public and private investment to build a globally competitive ecosystem. Members are encouraged to view and share the video as a resource for understanding Europe’s evolving strategy on semiconductors and electronics. Contact: Alison James

New Report on Tariffs and Europe’s Electronics Industry: The Global Electronics Association published a new report last week on the impacts of the recently concluded U.S.-EU tariff agreement. Beginning August 1, most European electronics exports to the United States are subject to a unified 15 percent tariff, which the paper estimates will add billions in annual duties. The tariffs also will raise costs for U.S. importers and consumers while disadvantaging European producers relative to competitors in Mexico and Asia.

Beyond the direct cost effects, the analysis highlights how this agreement reflects a broader departure from the World Trade Organization’s “Most Favored Nation” principle, which requires WTO members to extend the same trade advantages to all nations with MFN status, replacing it with a more fragmented global trade landscape. The pact compounds several existing challenges for Europe’s electronics industry, including high energy costs, regulatory burdens, and supply chain vulnerabilities, and it underscores the need for a coordinated European strategy across the electronics value chain. Contact: Alison James

|

Vietnam Electronics Growth Endures Despite U.S. Tariff Pressures: Vietnam is among the Asian economies hardest hit by new U.S. tariffs, with electronics, textiles, and footwear identified as particularly vulnerable sectors, according to the Asia News Network. Despite these pressures, Vietnam’s electronics industry continues to expand. Electronics now account for the largest share of the country’s trade with China, making up more than half of bilateral trade flows, as reported by Vietnam News. This underscores the sector’s importance to both Vietnam’s economy and its regional trade relationships.

At the same time, Vietnam is moving to strengthen strategic partnerships to diversify its technology base. A new Memorandum of Understanding signed with the Korea Fabless Industry Association will expand cooperation in artificial intelligence and semiconductors through joint R&D, training programs, and technology transfer, according to Vietnam News. These developments illustrate how Vietnam’s electronics sector is maintaining momentum even amid tariff headwinds, reinforcing its role as a key link in global supply chains. Contact: Gaurab Majumdar

Thailand Seeks to Expand Semiconductor Role with U.S. Roadshow: Thailand is stepping up efforts to move up the electronics value chain. According to The Nation Thailand, the country’s Board of Investment (BOI) and Ministry of Higher Education, Science, Research and Innovation held a U.S. roadshow this month to promote upstream semiconductor investment. The delegation met with major global chip companies including Intel, NXP, and Synopsys, while also signing a memorandum of understanding with Arizona State University to train 80,000 semiconductor professionals within five years. Officials said the initiative is part of Thailand’s long-term plan to attract 500 billion baht (US$13.6 billion) in foreign direct investment and establish a more comprehensive domestic semiconductor ecosystem. For electronics manufacturers, these efforts highlight the broader regional competition to secure new chip investment, workforce development, and supply chain integration. Contact: Gaurab Majumdar

|

Tariffs, Nearshoring, and New Investments Shape Mexico’s Electronics Industry: Mexico’s electronics industry is entering a period of both pressure and opportunity as trade, investment, and policy trends converge. President Claudia Sheinbaum has proposed tariffs of 10% to 50% on 1,371 import categories from countries without trade agreements with Mexico, including electronics. According to Mexico News Daily, the measure is designed to shield local industries such as automotive and manufacturing but could also raise costs for electronics inputs, creating new considerations for supply chain strategies.

At the same time, Mexico’s exports to the United States are surging. Between January and July, electronics and computer exports rose 49% year-on-year, capturing nearly a quarter of the share lost by China under U.S. tariffs, as reported by Mexico Business News. This reflects a clear shift toward nearshoring, with Mexico strengthening its role as a preferred hub for resilient supply chains serving North American markets.

Foreign investment is also accelerating. In the first five months of 2025, Guanajuato secured 22 new projects worth $2.2 billion, generating more than 9,400 jobs, according to Mexico Industry. The region’s momentum underscores how industrial clusters are attracting capital into automotive, electronics, and advanced manufacturing sectors.

Together, these developments illustrate how tariffs, nearshoring, and investment are reshaping Mexico’s position in global electronics production. The Global Electronics Association Mexico will continue to monitor policy proposals and advocate for competitiveness while helping members seize emerging opportunities. Contact: Lorena Villanueva

|

Association Recommends “Fit-for-Purpose” Sustainability Framework: The Global Electronics Association has released a new position on the European Union’s sustainability reporting framework, providing both voting recommendations on amendments proposed by the European Parliament’s Committee on Legal Affairs (JURI) and broader recommendations to the Parliament, Commission, and Council ahead of trialogue negotiations. For the electronics industry and its complex supply chain, the Association emphasizes that Tier-1 due diligence obligations are not only necessary but the only realistic approach. The position also supports adoption of sector-specific standards by 2030; stronger alignment across different sustainability reporting policies; and harmonization of implementation among EU Member States to prevent further regulatory fragmentation. Contact: Diana Radovan

Global Electronics Association to Join Sustainability Week Europe: As Europe navigates economic headwinds, companies in the electronics sector face increasing pressures to balance near-term profit challenges with long-term sustainability goals. Governments are reallocating green funds and tightening regulations, reshaping the competitive landscape for manufacturers.

Sustainability Week Europe, taking place in Amsterdam on October 6–7, will bring together more than 500 senior executives, policymakers, investors, and innovators to address these questions. According to organizers, discussions will focus on the future flow of sustainability investments, the role of transparency and ESG reporting, Europe’s competitiveness in green technologies, and the trade-offs between short-term gains and long-term resilience. Dr. Diana Radovan, the Global Electronics Association’s Director of Sustainability Policy, will attend the conference and report back. Members attending the event are encouraged to connect with her. Contact: Diana Radovan

EU Deforestation Regulation Timeline in Flux: Most electronics companies are expected to fall under the scope of the EU Deforestation Regulation depending on whether they operate in high-deforestation-risk regions and which natural resources they use. But now, based on a letter from Environmental Commissioner Jessika Roswall to the Chair of the Environmental Council, the implementation of EUDR might be facing a one-year postponement, to the end of 2026. Roswall says the IT systems required for reporting and compliance are not yet fully mature. The timeline for adoption remains unclear, and companies should continue preparing for compliance while monitoring for changes. The Global Electronics Association will track developments and update members as new information becomes available. Contact: Diana Radovan

U.S. EPA Opens Consultations Under TSCA: The U.S. Environmental Protection Agency (EPA) has released a draft risk evaluation for D4 (octamethylcyclotetrasiloxane) under the Toxic Substances Control Act (TSCA). According to the agency, the preliminary findings indicate that D4 poses an unreasonable risk to human health and the environment under certain conditions of use. D4, a cyclic silicone compound, is widely used in electronics, including in semiconductor manufacturing, where it often remains embedded in components and does not emit during use. The substance is already classified as a “substance of very high concern” (SVHC) by the European Chemicals Agency (ECHA) and is banned in EU personal care products due to persistence, bioaccumulation, and toxicity. EPA will accept public comments on the draft evaluation through November 17 via this docket, and it will convene a series of public meetings in the coming months.

Meanwhile, on September 23, the EPA also issued a proposed rule revising procedures for conducting chemical risk evaluations under TSCA. Comments are due November 7, 2025. The Global Electronics Association is gathering and consolidating member input to help shape industry feedback on the evaluation. Contact: Diana Radovan

U.S. EPA Advances Proposal To Ease PFAS Reporting Mandates: The U.S. Environmental Protection Agency (EPA) has submitted sent a proposal for review that would ease PFAS reporting requirements under the Toxic Substances Control Act (TSCA). The White House Office of Management and Budget (OMB) will review the proposal, which arose after a coalition of chemical companies argued the measure fails to align with the best reading of the toxics law. The rule currently requires companies to submit information about PFAS used in any year from 2011 until 2022. The OMB review typically takes 90 days. The Global Electronics Association will continue to monitor this development and keep members informed. Contact: Diana Radovan

European Chemicals Agency Provides Updates on PFAS Plans: The European Chemicals Agency (ECHA) has published an updated PFAS Restriction Background Document (not to be seen as final currently), Scientific Evaluation Status, and a process update with timelines. A public 2-month consultation regarding the SEAC (the Socio-Economic Committee of ECHA) draft opinion is expected in spring in a questionnaire format, for which the Association will consolidate member feedback. To support consultation preparation, ECHA will hold an online information session on 30 October 2025. Additionally, ECHA will confirm the exact starting date of the consultation in March 2026. The Association will have a face-to-face informal meeting with SEAC in Brussels in mid-October. Members are encouraged to start considering, ahead of the consultation window: potential impacts of restricting PFAS across sectors, e.g., repercussions of non-use scenarios such as no impact, closure of operations, relocation, or substitution of PFAS; availability and feasibility of alternatives; information on missed uses and derogations, where relevant to socio-economic aspects. For more information, read the recently released blog on this topic from the Global Electronics Association. Contact: Diana Radovan

|

|

|

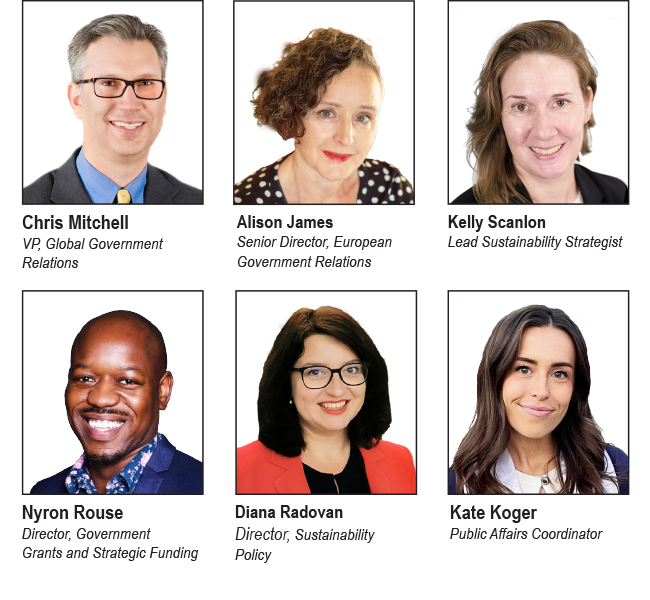

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |