|

Dear [Colleague]:

Government policy discussions on trade, sustainability, and regional cooperation continued to attract our attention this week.

Here in Washington, we are hours away from submitting official comments on potential tariffs on robotics, industrial machinery, and medical technology. Next week, we’ll submit comments on proposed “inclusions” in the steel and aluminum tariffs list, and by November 3, we will submit comments on the future of the U.S.-Mexico-Canada Agreement (USMCA). Please let us know your thoughts and questions.

Speaking of the United States and Mexico, the Global Electronics Association is releasing a new brief on Mexico’s critical role in U.S. manufacturing. Be among the first to read it.

Meanwhile, the European Parliament’s Legal Affairs Committee (JURI) adopted its position on the sustainability and due diligence “omnibus” package, and overall, it seems to be going in the right direction for electronics.

In Asia, Thailand is taking steps to strengthen its role in the global electronics value chain.

Keep reading for a look at the developments shaping the electronics industry this week.Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- Industry Hopeful on European Action on Sustainability and Due Diligence

QUOTE OF THE WEEK

- Industry Sustainability Strategist Appreciated Climate Week Dialogue

UNITED STATES

- Association Busy on Steel & Aluminum Tariffs, Chips, Machinery, USMCA and More

- Lawmakers Urge Tighter Controls on Chipmaking Equipment Exports

- U.S. Invests in Critical Minerals While Conflict with China Burns

- H-1B Visa Overhaul: What Do You Think?

MEXICO

- New Association Report Explains Why Mexico Matters to U.S. Manufacturing

- Mexico Advances Trade and Technology Initiatives

- United States and Mexico Collaborate on Semiconductors

ASIA-PACIFIC

ENVIRONMENT AND SUSTAINABILITY

- California Air Resources Board Seeks Feedback on Reporting Template

- Member Feedback Needed on Circular Economy Act

- Global Electronics Association Participates in Sustainability Week Europe

OTHER HEADLINES IN THE NEWS

- The Economic Times | India, South Korea to explore partnerships in EV components, digital supply chains

- The New York Times | The Small Company in Europe Caught in the Big Trade War Between the U.S. and China

UPCOMING EVENTS

- Circularity Policies for Electronics: Where Are We Now? Online, Nov. 11

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

Industry Hopeful on European Action on Sustainability and Due Diligence Omnibus: The Global Electronics Association welcomes the timely adoption by the European Parliament’s Legal Affairs Committee (JURI) of its position on the omnibus proposal on sustainability reporting and due diligence. In an Association blog , Sustainability Policy Director Diana Radovan, says: “Overall, we think that this position is going in the right direction for electronics. We welcome the voluntary approach to sector-specific standards and the removal of EU civil liability.”

The committee’s action paves the way to trialogue negotiations among the European Union institutions, which will start as planned at the end of October. “Regulatory certainty—including timely implementation of omnibus requirements by Member States— is needed to ensure business continuity and investment certainty,” Diana adds. “The Global Electronics Association will continue to advocate for a regulatory simplification that is effective and useful for businesses” she adds. Read the full statement on the JURI action on our Association blog .

You may read the JURI announcement; watch a press conference on it; and like and share our LinkedIn post. Contact: Diana Radovan

|

|

“Attending Climate Week reinforced for me just how important communication is. When dealing with complex products, intricate supply chains, and diverse global players, conversations can become tangled. Many people are already doing the right things, yet they often fail to communicate those efforts effectively. Measurement is difficult, and data can be unclear.”

— Dr. Kelly Scanlon, lead sustainability strategist of the Global Electronics Association, in a new Association blog about her participation in last month’s Climate Week events in New York City

|

Association Busy on Steel & Aluminum Tariffs, Chips, Machinery, USMCA and More: The Global Electronics Association continues to grapple with an array of business-critical trade policy issues in the United States.

Last week, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) posted nearly 100 more petitions seeking additions to the list of derivative products subject to a 50% “Section 232” tariff on steel and/or aluminum content. This is the second round of the process; the first round resulted in 400-plus additions to the list. Industry comments are due on Tuesday. If tariffs on these items would create any concerns for your company, let us know so that we can advocate for you. The BIS landing page for more information is here.

On another trade front, Dr. John W. Mitchell, president and CEO of the Global Electronics Association, wrote to Commerce Under Secretary Jeffrey Kessler, seeking a constructive dialogue on the potential impacts of planned Section 232 tariffs on semiconductor chips. Although we share the Administration’s goal of strengthening U.S. economic and national security, the apparent direction of the investigation raises concerns about costs, complexities, and unintended consequences for the broader electronics manufacturing ecosystem.

Later today, the Association will submit official comments on the Section 232 investigations of robotics, industrial machinery, and medical technology. By November 3, we will submit comments on the future of the U.S.-Mexico-Canada Agreement (USMCA), which is due for a trilateral review in 2026. As always, watch this space for more details, and let us know your questions and insights. Contact: Chris Mitchell

Lawmakers Urge Tighter Controls on Chipmaking Equipment Exports: The U.S.–China technology competition was spotlighted by new congressional findings on semiconductor manufacturing equipment exports. According to U.S. News & World Report, a bipartisan investigation by the House Select Committee on China found that Chinese chipmakers purchased approximately $38 billion worth of advanced chipmaking tools from U.S. and allied suppliers in 2024, a 66 percent increase from the previous year. The report cited inconsistencies in export control rules among the United States, Japan, and the Netherlands, which allowed non-U.S. manufacturers to continue selling to Chinese firms that are restricted under U.S. law.

As reported by the New York Post, committee members are calling for broader, more coordinated export restrictions to prevent potential loopholes and strengthen alignment among allied nations. According to reporting by Quartz, sales to China have already begun to decline in 2025 amid new regulations and greater coordination between Washington and Tokyo. The Global Electronics Association continues to monitor these policy shifts and assess potential implications for global supply chain resilience and competitiveness. Contact: Chris Mitchell

U.S. Invests in Critical Minerals While Conflict with China Burns: The U.S. government announced a series of investments aimed at strengthening domestic and allied production of rare earths and critical minerals needed for advanced manufacturing. According to The Street and Fox Business, the departments of War and Energy have begun taking direct equity stakes in mining and processing companies to reduce reliance on imports from China, which currently controls roughly 60–70 percent of global rare earths mining and 90 percent of refining capacity.

Meanwhile, China imposed new limits on exports of rare earths and related technologies. According to the Associated Press, the rules require foreign companies to get special approval to export items that contain even traces of rare earths elements, and they require permits for exports of technologies related to rare earths mining, smelting, recycling and magnet-making. President Trump threatened to impose retaliatory tariffs and export controls, CNBC reported.

The Global Electronics Association continues to monitor these policy shifts and their potential effects on material sourcing and long-term supply stability. Contact: Chris Mitchell

H-1B Visa Overhaul: What Do You Think? The Trump administration recently announced dramatic changes in the H-1B high-skilled worker visa program, and the Global Electronics Association needs to know your thoughts.

According to Forbes, the Trump executive order imposes a $100,000 annual fee, raises prevailing wage requirements, and allows the Department of Homeland Security to waive the fee in certain cases. Devdiscourse reported that the administration’s stated goal is to protect U.S. jobs and wages, but for tech companies, the policy raises concerns about access to skilled labor, cost burdens, and potential offshoring of critical roles.

The Global Electronics Association invites you to participate in a 5-minute survey on the impact of these changes; your input will shape industry advocacy. Contact: Chris Mitchell

|

New Association Report Explains Why Mexico Matters to U.S. Manufacturing: A new policy brief by the Global Electronics Association examines how an integrated U.S.-Mexico electronics supply chain underpins U.S. industrial strength, job growth, and national security.

According to the analysis, Mexico has become a vital production hub and re-export platform for electronics, helping U.S. manufacturers diversify sourcing and maintain competitiveness. Yet, rising U.S.-Mexico trade barriers could disrupt this integration, raising costs, slowing innovation, and undermining U.S. reshoring efforts in sectors such as defense, aerospace, and semiconductors. The report calls for a renewed U.S.–Mexico trade framework that protects tariff-free electronics trade and strengthens joint enforcement mechanisms to build a more resilient North American manufacturing ecosystem. Be among the first to read it, and stay tuned for our promotional launch of the report next week. Contact: Lorena Villanueva

Mexico Advances Trade and Technology Initiatives: Mexican President Claudia Sheinbaum reaffirmed her government’s commitment to securing favorable trade agreements and advancing local technology initiatives during her first annual address to the nation. According to U.S. News & World Report, Sheinbaum expressed confidence that Mexico will reach new trade accords with the United States and other nations, emphasizing efforts to align domestic industry with a rapidly evolving global trade environment. Sheinbaum announced that in the coming weeks, her administration will present progress on several “made-in-Mexico” initiatives spanning electric vehicles, semiconductors, satellites, and drones, alongside plans to establish a national artificial intelligence laboratory.

As reported by Reuters, Mexico has also implemented tariffs on imports from countries with which it does not hold trade agreements, most notably China, a move analysts view as a response to global trade pressures. Contact: Lorena Villanueva

United States and Mexico Collaborate on Semiconductors: Mexico and the United States are deepening semiconductor cooperation through Plan México, a binational effort to expand chip assembly, testing, and packaging capabilities across North America. According to El Heraldo de México, the initiative introduces new incentives, logistics upgrades, and talent programs designed to attract investment and integrate Mexican facilities into the regional semiconductor supply chain. The plan seeks to reduce reliance on Asia and strengthen the continent’s advanced manufacturing base. Contact: Lorena Villanueva

|

Thailand Expands Trade Ties and Advances PCB Manufacturing Capabilities: Thailand is taking steps to strengthen its role in the global electronics value chain through new international partnerships and rapid industrial growth. According to The Nation Thailand, the Thai government recently pledged to deepen trade and green technology collaboration with Australia, emphasizing opportunities in sustainable development, innovation, and bilateral investment. From January through August 2025, Australia ranked as Thailand’s 11th largest trading partner.

At the same time, Thailand’s printed circuit board (PCB) industry is gaining global prominence. As reported by a separate piece in The Nation Thailand, the country has now approved 180 PCB investment projects, placing it among the world’s top five PCB producers and first in ASEAN. The Board of Investment recently expanded incentives for manufacturers, including import duty exemptions and up to eight years of corporate tax relief. These developments reinforce Thailand’s growing position as both a competitive electronics hub and a potential partner for global manufacturers evaluating regional supply diversification. Contact: Gaurab Majumdar

|

California Air Resources Board Seeks Feedback on Reporting Template: The California Air Resources Board (CARB) has released its draft reporting template for Scope 1 and Scope 2 greenhouse gas (GHG) emissions under Senate Bill 253. The template, first previewed during CARB’s August 21 public workshop, will be voluntary for 2026 reporting. According to CARB, additional guidance for later reporting cycles will be provided through its ongoing regulatory process.

CARB also published a draft memo outlining instructions for using the template and is inviting public comment to help refine its design. As noted in the memo, CARB is particularly seeking feedback on disclosure by source versus by gas, organizational boundaries, and emissions reduction initiatives. Comments may be submitted to CARB’s public docket through October 27. Access the draft materials and submit feedback here. Contact: Diana Radovan

Member Input Needed on Upcoming Circular Economy Act: The Global Electronics Association is gathering and consolidating member perspectives from across the electronics value chain regarding the upcoming Circularity Act consultation, in response to the call for input launched by the European Commission. Members are encouraged to complete the consultation survey and to share the link with colleagues or partners who can provide informed feedback so their views are reflected as well. Also, don’t miss our upcoming webinar on circularity, which is listed below. Contact: Diana Radovan

Global Electronics Association Participates in Sustainability Week Europe: Last week, sustainability leaders from around the globe, including the Global Electronics Association, took part in Sustainability Week Europe in Amsterdam. The conference explored shifting sustainability regulations and investment priorities, as well as the broader transition toward greener, more resilient industrial strategies. Dr. Diana Radovan, the Association’s Director of Sustainability Policy, participated on our behalf; read her thoughts in this Association Blog. Contact: Diana Radovan

|

Circularity Policies for Electronics – Where Are We Now? Online, Nov. 11. This webinar, co-hosted by the Global Electronics Association and the Anthesis Group, will offer an update on the current state-of-play on emerging circularity policies for electronics, from the perspectives of advocacy, compliance, and standards development. It will take place on Tuesday, November 11, between 4 and 5 pm CET. Register today and join the conversation. Contact: Diana Radovan

|

|

|

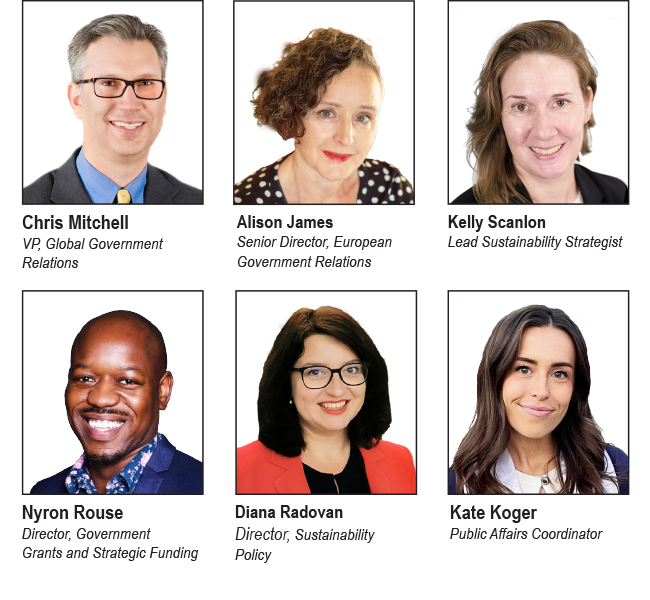

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |