|

Dear [Colleague]:

Global attention turned to Asia this week as a wave of new trade deals took center stage. In a meeting in South Korea, U.S. President Donald Trump and Chinese President Xi Jinping reached an agreement that pauses China’s latest rare earth export restrictions. But questions still remain about semiconductors and other issues.

Meanwhile, Trump’s Asia tour produced several other new agreements that are set to reshape regional supply chains, deepen U.S. access to strategic materials, and reinforce Southeast Asia’s role in global electronics production.

In PCB007 Magazine, Global Electronics Association East Asia President Sydney Xiao offers timely insights into how China’s electronics industry is adapting to shifting global trade patterns.

In Brussels, the Global Electronics Association Europe convened industry leaders and the European Commission to discuss the future of the Chips Act.

Keep reading for the latest developments shaping the electronics industry worldwide.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- Trump and Xi Reach Rare Earths Agreement, but Semiconductor Talks Stall

- Critical Minerals and Trade Diversification Drive New U.S.-Asia Deals

- China’s Electronics Industry Adapting to New Trade Dynamics

QUOTE OF THE WEEK

- PCB Manufacturers Must Unite on Policy in Europe

EUROPE

- Association Urges Movement Toward a “Chips Act Plus” Approach

- European Commission Outlines Its Working Plan for 2026

UNITED STATES

- U.S. and Australia Finalize $8.5 Billion Critical Minerals Agreement

ASIA-PACIFIC

- India and Malaysia Expand Roles in Global Electronics Manufacturing

ENVIRONMENT AND SUSTAINABILITY

- Get Involved in the Association’s Revised PFAS Position and Stay Informed

- EU Publishes Simplified Carbon Border Adjustment Mechanism (CBAM) Regulation

OTHER HEADLINES IN THE NEWS

- NBC News | American e-waste is causing a 'hidden tsunami' in Southeast Asia, report says

- The New York Times | Step by Step, How China Seized Control of Critical Minerals

UPCOMING EVENTS

- Circularity Policies for Electronics: Where Are We Now? Online, Nov. 11

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

Trump and Xi Reach Rare Earths Agreement, but Semiconductor Talks Stall: At their first in-person meeting in six years, U.S. President Donald Trump and Chinese President Xi Jinping reached limited agreements focused on easing trade tensions but stopped short of a broader breakthrough. As reported by DPA, China agreed to suspend for one year its newly announced restrictions on exports of rare earth minerals, which are used in semiconductors, circuit boards, and electric motors, while the United States rolled back certain export blacklists on Chinese firms. The temporary pause, which Beijing described as a review of its October 9 export policy, aims to stabilize global supply chains amid ongoing tariff pressures.

According to Yahoo! Finance, Trump called the talks “amazing” and confirmed that China will allow rare earth exports “for at least another year,” while the U.S. reduces a 20% tariff on certain Chinese goods tied to the fentanyl crisis. However, the meeting produced no progress on semiconductor export restrictions involving U.S. chipmaker Nvidia, with Trump stating that Beijing and the company would “work that out themselves.”

For electronics manufacturers, the rare earths reprieve offers at least short-term relief, while uncertainties over semiconductors and other goods continue to hang over our industry. Contact: Chris Mitchell

Critical Minerals and Trade Diversification Drive New U.S.-Asia Deals: U.S. President Donald Trump signed a series of trade and critical minerals agreements this week with several Southeast Asian nations, marking a major step toward reshaping regional supply chains. As reported by Arab News, Trump and Malaysian Prime Minister Anwar Ibrahim formalized a U.S.-Malaysia agreement granting Washington guaranteed access to critical minerals and rare earth magnets.

According to The Nation Thailand, Trump also inked agreements with Thailand, Cambodia, and Vietnam, including tariff reductions on some goods and new commitments on digital trade, labor protections, and environmental standards. Malaysia secured further exemptions for aerospace and pharmaceutical exports, while Thailand committed to purchasing U.S. aircraft and energy products and to lifting foreign investment restrictions in telecommunications. Vietnam and Cambodia agreed to frameworks aimed at reducing tariff and non-tariff barriers while expanding U.S. product imports to narrow trade imbalances.

As reported by Economic Times Manufacturing, Washington simultaneously granted 0 percent import tariffs on select goods from Malaysia, Thailand, and Cambodia, reversing a previous 19 percent tariff and signaling an effort to strengthen economic ties with the region. Contact: Gaurab Majumdar

China’s Electronics Industry Adapting to New Trade Dynamics: A feature in PCB007 by Sydney Xiao, President of the Global Electronics Association East Asia, explores how China’s electronics sector is adjusting to global trade realignments through diversification and sustainability rather than contraction. As Xiao writes, “It is erroneous to suggest that China is replaceable in the electronics supply chain. Collaboration will define the future under new terms: greener, more transparent, and more resilient supply chains.” The article notes that while the U.S. and Europe continue to pursue “reshoring,” China continues to anchor global electronics manufacturing, with companies expanding into Southeast Asia to hedge against tariffs while maintaining R&D leadership. It also emphasizes that new carbon-neutrality commitments and emissions reporting frameworks are turning sustainability into a source of competitive advantage for manufacturers across the region.

This perspective offers valuable context for electronics manufacturers navigating supply-chain diversification, regulatory adaptation, and sustainability reporting in Asia. Members seeking insight into regional dynamics can read the full article in PCB007 Magazine, October 2025 issue. Contact: Sydney XIAO

|

|

“PCB fabricators have learned that they need to raise a common voice for Europe, because we are not organized on a national level. For example, there is the French Association, the Italian Association, the German Association, and the UK … and the Global Electronics Association can have a voice to speak for all the countries.”

— Kevin Tastets, group sales director of Group ACB, based in France and Belgium, in an article in Community Magazine about policy advocacy for PCB manufacturers in Europe.

|

Association Urges Movement Toward a “Chips Act Plus” Approach: The Global Electronics Association Europe this week hosted a workshop on the future of the European Chips Act at the request of the European Commission. The session, opened by Pierre Chastanet, Head of Unit for the Chips Act, gathered PCB and EMS companies to share perspectives as part of the Commission’s official review. The discussion provided an opportunity for the Association, member companies, and partner industry groups to highlight the importance of a “Chips Act Plus” framework, one that extends support across the full electronics value chain and strengthens Europe’s long-term competitiveness. Learn more about our advocacy effort in Europe, including our Industry Call to Action, on electronics.org. Contact: Alison James

European Commission Outlines Its Working Plan for 2026: Last week, the European Commission released its 2026 Work Program, setting out an agenda centered on sustainability, innovation, and competitiveness. The plan aims to create “a more sovereign and independent Europe” through initiatives such as the European Innovation Act, Advanced Materials Act, Cloud and AI Development Act, Circular Economy Act, European Product Act, and Digital Fairness Act. Simplification is emphasized across all measures.

The program also confirms an evaluation of the European Chips Act in early 2026, with industry comments due by November 28 (see related story above). The Global Electronics Association is preparing input consistent with its position that the EU should expand investment in semiconductor fabrication and advanced packaging, while strengthening PCB and systems assembly for critical industries.

Also last week, the European Parliament adopted a report recommending updates to the New Legislative Framework (NLF) for products, emphasizing circular economy goals and positioning the Digital Product Passport as a key tool for compliance and surveillance. Lawmakers called for alignment with Right to Repair and Waste Framework directives and harmonized definitions for “remanufacturers,” “refurbishers,” and “repairers.” During the plenary debate, Commission Executive Vice President Stéphane Séjourné announced a 2026 package to revise the NLF, market surveillance rules, and standardization. Contacts: Alison James and Diana Radovan

|

U.S. and Australia Finalize $8.5 Billion Critical Minerals Agreement: The United States and Australia signed a new $8.5 billion critical minerals partnership last week aimed at strengthening global supply chains for rare earths and other essential inputs to advanced manufacturing. As reported by the Associated Press, the deal follows recent Chinese export restrictions on rare earths and related Chinese goods. Industry analysts say the U.S.-Australia pact could diversify global sourcing, reduce market volatility, and promote competition in a sector historically dominated by China. Early stages of the plan include more than $3 billion in joint projects within six months, focusing on materials such as lithium, cobalt, and rare earths used in semiconductors, batteries, and clean energy systems. For the electronics industry, expanded production capacity in Australia could lead to a more stable supply for U.S. and allied manufacturers, while also influencing pricing and availability across global markets, particularly in Asia. The Global Electronics Association is monitoring this new pact and invites your input on how this may affect your business. Contact: Chris Mitchell

|

India and Malaysia Expand Roles in Global Electronics Manufacturing: Southeast Asia’s importance in the global electronics ecosystem continues to grow as Malaysia and India accelerate investments in semiconductor manufacturing and adopt policy reforms. According to Reuters, Malaysia is building on decades of strength in assembly, testing, and packaging through its National Semiconductor Strategy and New Industrial Master Plan 2030, securing more than USD $16 billion in semiconductor investments since early 2024. Backed by the Malaysian Investment Development Authority, the country is advancing into chip design, advanced packaging, and innovation to position itself as a high-value regional hub.

In India, the Ministry of Electronics and Information Technology is preparing a list of imported electronic inputs eligible for duty reductions, The Economic Times reports, to lower production costs and attract global investment. Both nations are also deepening cooperation in semiconductor development and workforce training, according to Communications Today. Together, these efforts are strengthening Southeast Asia’s role as a resilient, innovation-driven engine for the global electronics industry. Contact: Gaurab Majumdar

|

Get Involved in the Association’s Revised PFAS Position and Stay Informed: The Global Electronics Association is revisiting its per- and polyfluoroalkyl substances (PFAS) position in light of emerging restrictions for electronics and semiconductors and plans to submit it to the European Chemicals Agency (ECHA) in mid-November. The ECHA September podcast offers useful context regarding upcoming PFAS restrictions. Additionally, ECHA hosted a PFAS webinar on October 30, providing further information on the upcoming SEAC consultation (planned for March 2026), and the slides are now available. To engage in the Association’s position on PFAS and get more information on forthcoming restrictions affecting electronics and semiconductors, contact Diana Radovan.

EU Publishes Simplified Carbon Border Adjustment Regulation: The European Union’s amended Carbon Border Adjustment Mechanism (CBAM) regulation was published in the Official Journal on October 17 and entered into force on October 20. The update introduces several key simplifications aimed at easing compliance and aligning CBAM more closely with the EU Emissions Trading System. Changes include an exemption for CBAM goods imports below 50 tons per year (excluding hydrogen and electricity); the ability for importers to deduct carbon costs paid in third countries; and the option to delegate reporting through a CBAM representative. Further non-legislative acts are expected to finalize the framework in the coming months. Any questions? Contact: Diana Radovan

|

Circularity Policies for Electronics – Where Are We Now? Online, Nov. 11. This webinar, co-hosted by the Global Electronics Association and the Anthesis Group, will offer an update on the current state-of-play on emerging circularity policies for electronics, from the perspectives of advocacy, compliance, and standards development. It will take place on Tuesday, November 11, between 4 and 5 pm CET. Register today and join the conversation. Contact: Diana Radovan

|

|

|

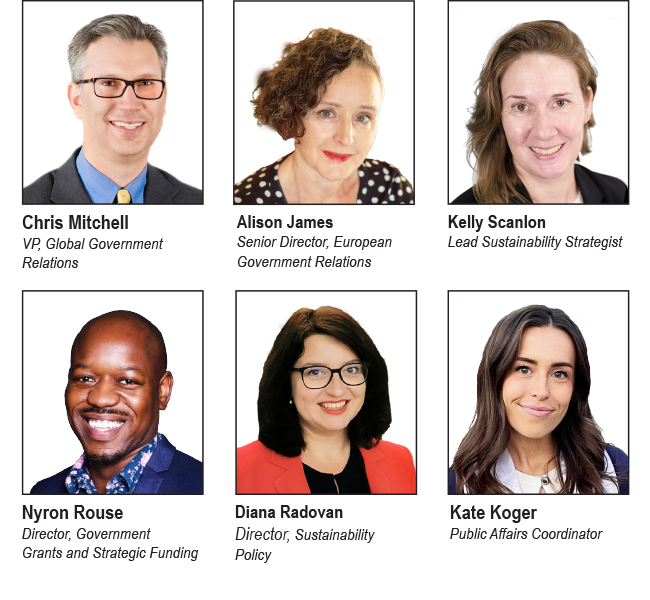

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |