| 3/7/25 |

|

Dear [Colleague]:

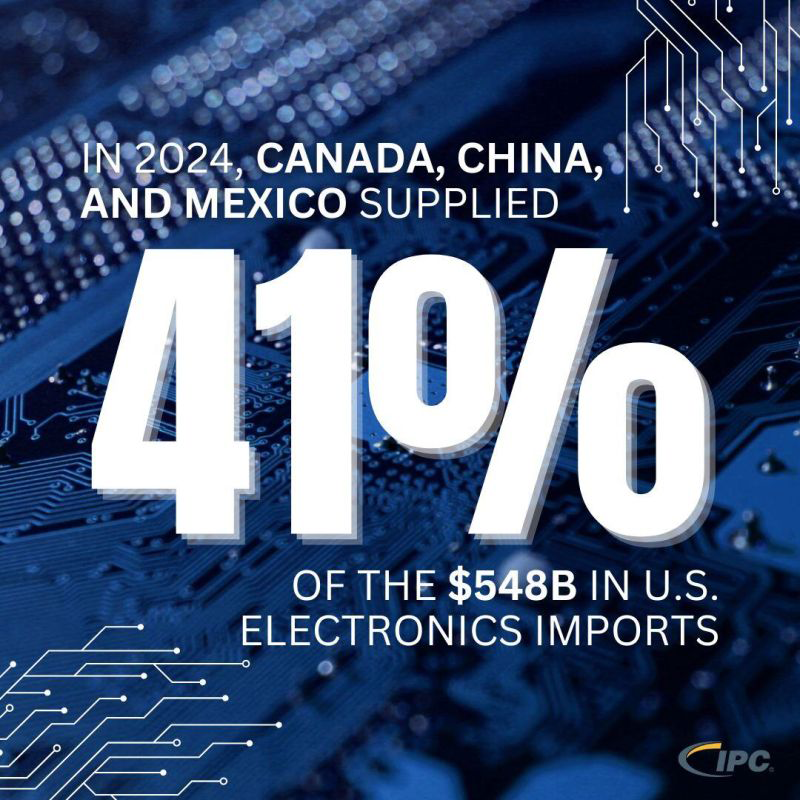

While there were no new U.S. trade actions this week that directly affected electronics – for the first time in over a month – the threat of a prolonged trade war that disrupts our industry seems more and more likely. This week, IPC submitted industry comments on the emerging policy of reciprocal tariffs on U.S. trading partners, and we gathered industry intelligence on potential copper tariffs.

As part of our effort to include more international news in the Global Advocacy Report, this week we have a special report from IPC Mexico Director Lorena Villaneuva on how our southern neighbor is navigating the trade turbulence.

Meanwhile, the U.S. defense spending bill for FY25 is finally done, and the outcome could have been worse, but there is still more work to be done.

Will we see you at IPC APEX EXPO next week?

Keep reading for all the details, and as always, let us know your thoughts.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- U.S. Defense Spending Bill Is Step Forward, But More Work Remains

QUOTE OF THE WEEK

- IPC Concerned About Impacts of More U.S. Tariffs

UNiTED STATES

- IPC Urges Caution on Reciprocal Tariffs, Seeks Data on Copper

- New U.S. Labor Secretary Pledges Focus on Workforce and Manufacturing

- CHIPS Act Under Fire; TSMC Doubles Down on U.S. Investment

MEXICO

- Mexico Navigates Trade Challenges with Growth in Semiconductors and EVs

- Mexican Automotive Suppliers Gain Support Through New State Initiative

EUROPE

- European Commission Unveils Automotive Action Plan

ASIA

- Industry Leaders Convene at IPC’s Tokyo Roundtable

OTHER HEADLINES IN THE NEWS

- The Nation | Southeast Asia chip sector seen holding up

- NPR | Taiwanese chip giant's investments in U.S. stir 'silicon shield' security worries

UPCOMING EVENTS

- IPC APEX EXPO 2025: Anaheim, California, March 15-20

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

U.S. Defense Spending Bill Is Step Forward, But More Work Remains: The final U.S. Government spending package for Fiscal 2025 – expected to be approved today and signed by President Trump – includes $463.4 million for Defense Production Act (DPA) purchases, which will likely include purchases of trusted printed circuit boards (PCBs) that are at the heart of every military and civilian electronic system. In a statement, IPC President and CEO Dr. John W. Mitchell said, “IPC is encouraged by this outcome, but there is more short-term and long-term work to be done to ensure the United States rebuilds its weakened defense electronics industrial base.”

The final funding level for DPA purchases in FY25 is essentially the same as in FY24, which was a marked improvement from the year before. IPC worked throughout 2024 to educate lawmakers on this issue and maintain or build on that funding level. The outcome could have been worse, as the Biden administration actually proposed a cut in this account in FY25.

The bill also includes a provision that requires the Defense Department to provide a spending plan for the DPA funds within 45 days. IPC is already working to ensure that the DOD includes PCBs and related electronics technologies in that plan.

IPC now faces the even bigger challenge of advocating for more robust funding and demand signals for the electronics ecosystem in FY26 and beyond. Said Mitchell: “We’ve made good progress since President Trump first spotlighted this problem in 2018 and started to reverse the prior decades of neglect. If we go backward now, it will undermine U.S. business certainty and lead to a shrinkage of the U.S. defense electronics industrial base.” IPC Contact: Richard Cappetto.

|

–Excerpt from IPC’s comments to the U.S. Trade Representative on the possibility of imposing reciprocal tariffs on U.S. trading partners (related story below)

|

North American Trade Tensions Remain High: The state of North American trade and tariff policies remains tense, with ouof all the relevant official trade policies along with IPC analysis on our trade policy webpage; and let us know how these actions are affecting your company. IPC Contact: Chris Mitchell.

Apple Announces $500B Investment in U.S. Manufacturing: Last week, Apple announced plans to invest $500 billion in the United States over the next five years, significantly expanding its commitment to U.S. manufacturing and innovation. The investment includes opening a new server factory in Houston, establishing a manufacturing academy in Detroit, and expanding data centers across seven states. Apple’s pledge also reinforces U.S.-based semiconductor production, following confirmation that TSMC’s Arizona facility has begun chip production for Apple products. The announcement has implications for the U.S. electronics industry, potentially reshaping supply chains and creating up to 20,000 new jobs in engineering, R&D, and AI. Globally, Apple's investment could set a precedent for increased onshore manufacturing and resilience. IPC will continue monitoring these developments and advocating for a strong and innovative electronics manufacturing ecosystem in all countries. IPC Contact: Richard Cappetto.

|

Mexico Navigates Trade Challenges with Growth in Semiconductors and EVs: Mexico’s electronics manufacturing industry faces new uncertainties in light of the U.S. Government’s imposition of 25% tariffs on many imports, reports IPC Mexico Director Lorena Villanueva. Automotive and electronics products together account for nearly half of Mexico’s exports. Some companies, including Compal Electronics and Inventec, are considering shifting operations to the U.S. to avoid higher costs, while Foxconn and Intel are expanding semiconductor production in Mexico to replace Asian suppliers. Meanwhile, Mexico’s aerospace and EV sectors continue to grow, with Monterrey emerging as an aerospace hub and EV maker Zacua strengthening domestic supply chains. IPC Contact: Lorena Villanueva.

Mexican Automotive Suppliers Gain Support Through New State Initiative: The Mexican state of Aguascalientes recently launched the State Supplier Development Program to strengthen local industry, starting with the automotive sector. The initiative provides technical support, training, and direct connections with major companies to enhance supplier competitiveness. A collaboration agreement has been signed between Industria Nacional de Autopartes (INA), representing the national auto parts industry, and the International Finance Corporation (IFC) to expand the program nationwide. The moves are intended to reinforce Aguascalientes’ position as a hub for advanced manufacturing and auto parts production. IPC Contact: Lorena Villanueva.

|

European Commission Unveils Automotive Action Plan: Last week, the European Commission launched a new Automotive Action Plan, outlining its vision for the industry’s evolution over the next five to 10 years. The plan is centered on five “pillars”: innovation and digitalisation; “clean mobility”; competitiveness and supply chain resilience; skills and the social dimension; and market and trade policy. Before the plan was released, IPC submitted comments to the “strategic dialogue” that preceded the action plan, emphasizing the critical role of a resilient European electronics industry in supporting the automotive sector’s needs. IPC supports well integrated strategies that bolster industrial competitiveness amid geopolitical shifts. Please let us know your thoughts on the Automotive Action Plan, and learn more here. IPC contact: Alison James.

|

Industry Leaders Convene at IPC’s Tokyo Roundtable: Last week, IPC successfully launched its new Quarterly Leadership Roundtable series in Tokyo, which brought together more than 60 leaders of Japanese companies and government agencies for high-level discussions on the most pressing issues in our industry. The featured speakers, including IPC CEO John Mitchell, who is fluent in Japanese, and Akira Amari, a former member of Japan’s House of Representatives, provided valuable insights into the future of bilateral trade, technological cooperation, and the evolving global supply chain. The Tokyo Leadership Roundtables will continue throughout the year, stay tuned for updates on upcoming sessions. IPC Contact: Chris Mitchell.

|

IPC APEX EXPO 2025 (Anaheim, California), Mar. 15-20: Next week, discover the newest innovations and hear from the best minds in the electronics manufacturing industry. IPC APEX EXPO 2025 is our industry’s largest event in North America, featuring a world-class trade show, professional development courses taught by industry experts, non-stop networking and more. Learn more and register here.

|

John Mitchell says, “My hope is that we can focus on solutions that boost North American manufacturing rather than undermine it. Let’s use this time wisely. It’s not just about trade, it’s about the future of electronics innovation in the U.S.”

|

Stat of the Week: For more up-to-the-minute news on tariffs and trade policy, visit IPC’s trade policy page: www.ipc.org/advocacy/trade-policy. |

KEEP IN TOUCH & JOIN OUR EFFORTS Meet the IPC GR Team: Whether it is engaging with policymakers in the Americas, the European Union, or Asia, the IPC Government Relations (GR) Team proactively seeks opportunities to educate, inform and influence policymakers on policies that spur innovation, growth and competition, while protecting human health and the environment. But our success depends on your support and engagement. Learn more and get involved in IPC advocacy today! IPC Contact: Chris Mitchell.

In the U.S., take IPC’s five-minute public opinion survey and contact your elected officials via the IPC Action Alert Center. Peruse our global Advocacy pages on IPC.org or our European pages on IPC.org and LinkedIn. Subscribe to this IPC Global Advocacy Report: If you are a member of IPC, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not an IPC member — or if you are not sure — please send a note to friends@ipc.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share!

|