|

Dear [Colleague]:

We’re also watching for a new wave of tariffs today on imports from key U.S. partners, even as a series of last-minute trade deals signal de-escalation on some fronts. From Brussels to Manila, governments are recalibrating their terms with Washington.

Don’t miss the latest column from our colleague Jim Will of the U.S. Partnership for Assured Electronics (USPAE) who argues the lack of U.S. manufacturing of flat panel displays (FPDs) and the subsequent reliance on Chinese sources present potentially catastrophic risks to the U.S. military, economy, and infrastructure.

Amid so much consequential activity, I regret to report that Richard Cappetto, who for the last two years served as our Senior Director of North American Government Relations, has returned to Capitol Hill to take a senior role in the U.S. Senate. Rich has been a wonderful colleague and a tremendous advocate for the electronics industry. We’ll miss him, but we’re glad to still have him on speed dial.

Keep reading for these and more developments and how they could affect your business. As always, we welcome your input and engagement.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- Copper Tariffs Finalized, Sparking Industry Worries

QUOTE OF THE WEEK

- Rich Cappetto: Member Input Remains Key to Our Advocacy

UNITED STATES

- Other New Tariffs Formalized, Reshaping Global Electronics Trade

- U.S. AI Action Plan Should Revive Focus on the Electronics Inside

MEXICO

- Electronics Manufacturing Footprint Expands Across Mexico

ASIA

- India’s Electronics Exports Reach New Milestone with Global Ripple Effects

ENVIRONMENT AND SUSTAINABILITY

- EC Pursues Simplification of Environmental Rules and Circular Economy Act Consultation

- Sustainability Reporting Omnibus Moves Forward in European Parliament

- U.S. Defense Department Releases 2025 PFAS Update; Minnesota Extends Reporting Period

- EFRAG Releases Key Insights from First Wave of CSRD Reports

OTHER HEADLINES IN THE NEWS

- Defense Opinion | Domestic Production of Flat Panel Displays Critical to National Security

- The Wall Street Journal | U.S. Exporters Get Welcome Surprise in Trump Tax Law

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

Copper Tariffs Finalized, Sparking Industry Worries: On Wednesday, U.S. President Donald Trump announced a 50 percent tariff on semi-finished copper products and copper-intensive derivatives, but not the raw metal, effective today, August 1. Adjustments were also released that day. The policy, issued under Section 232 of the Trade Expansion Act of 1962, targets goods like copper sheets, pipes, wires, connectors, and electrical components. A formal inclusion process will also determine how broader copper-containing goods may be affected. The full details are not yet available.

According to Reuters, the move caused U.S. copper prices to plunge on fears of suppressed U.S. demand. While the White House says the tariff is necessary to rebuild domestic mining and smelting, electronics manufacturers warn it may drive up production costs and add stress to supply chains.

The Global Electronics Association issued a statement that says our industry is “disappointed” by the action, which “will hit U.S. printed circuit board (PCB) fabricators especially hard. … With no scalable domestic supply, U.S. electronics manufacturers will face higher costs, delay investments, and potentially even cut jobs. … This move directly undercuts President Trump’s goal of rebuilding American manufacturing and promoting American exports in strategic sectors.”

In a meeting with White House officials last week, the Global Electronics Association urged policymakers to exempt electronics-grade copper inputs, and we presented the results of our survey of U.S. board fabricators and EMS firms on the potential impacts. Depending on the specific details, many fabricators anticipate a 10% to 30% increase in manufacturing costs if the tariff takes effect. With most electronics-grade copper foil and laminates still sourced from Asia, and with only limited U.S. capacity available, the risk of cost increases remains high. Check out this Industry Intelligence Brief from the Global Electronics Association for the complete analysis.

Companies should assess their exposure and consider strategies including supply diversification, increased recycling, and potential material substitutions. Contact: Chris Mitchell

|

|

“Our Government Relations team is committed to serving our members with timely, actionable information on public policies coming out of Washington that may impact their businesses. Ultimately, our advocacy priorities are driven by member input. It's essential that we hear from companies across all segments of the industry on the public policy challenges they're facing. No matter the issue, member voices are often the most powerful way to make a compelling case to policymakers on Capitol Hill and in the White House.”

— Richard Cappetto, recently departed Director of North America Government Relations for the Global Electronics Association, in an article for the Summer 2025 edition of the Global Electronics Association Community Magazine we’re going to keep him on speed dial.

|

Other New Tariffs Formalized, Reshaping Global Electronics Trade: New U.S. tariffs on imports from many key trading partners are expected to take effect today, Friday, August 1, even as a flurry of recent trade agreements signaled a shift away from more intense confrontation.

Over the weekend, the United States finalized a deal with the European Union, while other agreements have been struck with Japan, Vietnam, South Korea, the Philippines, and Indonesia. Although the deals include base import tariffs of around 15%, they do provide some clarity for electronics manufacturers and defuse the threat of even higher tariffs for now. More trade deals and tariff announcements are possible today.

The Global Electronics Association views these developments in the context of its recent report on international trade flows in the electronics industry. A key conclusion was that to remain a major electronics producer, any country including the United States must also remain a major importer of specialized inputs. Trade relationships with countries supplying semiconductors, PCBs, laminates, and raw materials are not just economic concerns, they are essential to sustaining domestic electronics manufacturing, innovation, and national security.

As the new tariffs begin today, the Association continues to urge officials to exempt critical inputs and is working with member companies to understand and prepare for the evolving landscape. Watch our social media accounts and Trade Policy web page for more details as they emerge. Contact: Chris Mitchell

U.S. AI Action Plan Should Revive Focus on the Electronics Inside: U.S. President Donald Trump last week unveiled a new National AI Action Plan and signed a trio of executive orders aimed at advancing U.S. leadership in the Global AI race. In a new blog, the Global Electronics Association applauds much of the plan and urges the Administration to prioritize the development of domestic electronics manufacturing capacity, which is a critical foundation for AI leadership. Last October, the Association published a paper that concluded several electronics sub-sectors are “critically important” for AI and in need of significant government support to create a stronger supply chain.

The plan also has good provisions on developing a AI-skilled workforce, convening industry stakeholders, and leveraging the Defense Production Act to scale up strategically important technologies like electronics. Contact: Chris Mitchell

|

Electronics Manufacturing Footprint Expands Across Mexico: New developments across Mexico are reinforcing its role as a strategic manufacturing base for global supply chains. In Baja California, firms like Coast Aluminum, Aleaciones Especiales, and Tuvnord are strengthening the domestic aerospace ecosystem through precision materials, AS9100/AS9120 certifications, and integrated services, as reported by Mexico Industry. These advancements improve local sourcing options for OEMs and Tier‑1 suppliers, offering enhanced lead times and reduced regulatory risk.

In Aguascalientes, industrial parks such as FINSA, Tecnopolo II, and VESTA are attracting record levels of investment in automotive, logistics, and electronics manufacturing, according to Mexico Industry. Meanwhile, Mexico Now reports that South Korean auto supplier SL Corporation has announced a US$45 million investment to build a new facility in San Luis Potosí’s Logistik II Park. The project will double the company’s nearshoring capacity in Mexico and reflects continued foreign interest in the region’s Tier‑1 and Tier‑2 supplier base.

For electronics manufacturers, these trends suggest growing opportunities to integrate with certified suppliers, scale production closer to North American end markets, and leverage established infrastructure for future growth. Contact: Lorena Villanueva

|

India’s Electronics Exports Reach New Milestone with Global Ripple Effects: India’s electronics exports surpassed $40 billion in FY 2024, marking a 47 percent year-over-year increase, according to official figures reported by MSN India and The Economic Times. The top destinations for India’s exports included the United States, United Arab Emirates, and China. Union IT Minister Ashwini Vaishnaw attributed the momentum to manufacturing growth under India’s Production-Linked Incentive (PLI) scheme, particularly in mobile phones, IT hardware, and components.

As has been reported, India’s government is now targeting expanded capacity in high-tech segments such as semiconductor manufacturing and automotive electronics. These developments are contributing to a shifting global landscape, as companies evaluate new supply chain hubs and cost structures across Asia. Contact: Gaurab Majumdar

|

EC Pursues Simplification of Environmental Rules and Circular Economy Act Consultation: Last week, the European Commission opened a new call for evidence aimed at simplifying environmental compliance across several key regulatory frameworks, including industrial emissions, waste, and circular economy rules. According to the Commission, the planned “environmental omnibus” proposal, which is expected in Q4 2025, may include streamlining of reporting obligations, digitalisation of compliance processes, and potential changes to extended producer responsibility rules. Feedback is being collected through the Have Your Say portal until September 10, and the Global Electronics Association is seeking member input for a coordinated industry response.

Separately, a public consultation on the forthcoming Circular Economy Act will launch shortly and remain open for three months. Members are encouraged to share input for inclusion in the association’s official comments. Contact: Diana Radovan

Sustainability Reporting Omnibus Moves Forward in European Parliament: Parliamentary negotiations continue on the European Commission’s Omnibus I Simplification Package. The commission proposed changes to the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD) back in February. The parliament’s Legal Affairs Committee (JURI) on July 15 published its proposed amendments so far on July 15 and will adopt its position by October 13, ahead of a plenary vote planned for November. The full legislative process could extend into late 2025, pending trilogue negotiations, i.e., three-way negotiations between the European Parliament, the Council of the European Union, and the European Commission. The Global Electronics Association is actively reviewing the amendments and seeking member input for a consolidated industry response.

In a parallel yet related process, EFRAG will submit revised European Sustainability Reporting Standards (ESRS) to the European Commission by November 30. Contact: Diana Radovan

U.S. Defense Department Releases 2025 PFAS Update; Minnesota Extends Reporting Period: The U.S. Department of Defense has published its 2025 Update on Critical PFAS Uses, expanding on its 2023 baseline and highlighting growing civil-military dependencies on fluorochemicals. According to the report, mission-critical applications now include textiles, barriers, coatings, batteries, and medical devices, many of which have no current substitutes. The DoD warns that “structural” definitions of PFAS, when applied without toxicity data, are fueling regulatory fragmentation and supply chain disruption. The agency outlines a phased strategy to maintain defense readiness while gradually transitioning to safer alternatives, a process expected to take decades.

Separately, the Minnesota Pollution Control Agency announced an extension of its PFAS reporting deadline for intentionally added substances in products from January 1 to July 1, 2026. As this date now overlaps with the EPA’s TSCA Section 8(a)(7) PFAS reporting period, manufacturers will need to prepare two parallel submissions, each with partially different data requirements and PFAS definitions. Contact: Diana Radovan

EFRAG Releases Key Insights from First Wave of CSRD Reports: EFRAG has published its analysis of 656 initial corporate sustainability reports filed under the Corporate Sustainability Reporting Directive (CSRD). As summarized in EFRAG - ESRS Reporting Insights, the average report length was 115 pages, with significant variation by country and sector. High-level structure was generally similar, supporting comparability across disclosures. However, gaps remain. Only 10 percent of companies reported on all 10 ESRS topical standards, and just 20 percent consulted unions in their double materiality assessments. Climate transition plans were reported by 55 percent of companies, though formats varied. Underreported areas included biodiversity, internal carbon pricing, and human rights incidents. Members are encouraged to review the full findings. Contact: Diana Radovan

|

|

|

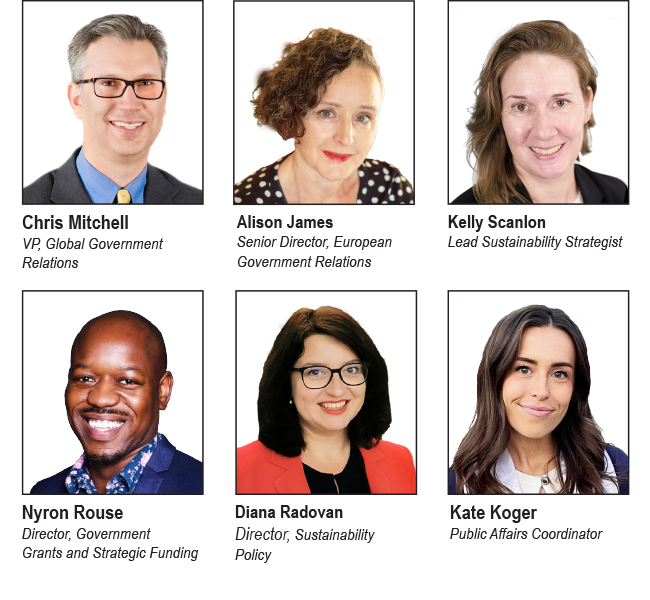

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |