|

Dear [Colleague]:

This week’s developments brought more shifts to the global trade environment, and electronics manufacturers are still caught in the cross currents.

A wave of new U.S. tariffs and deadlines is reshaping electronics supply chains across the globe, and U.S. President Donald Trump has now signaled plans for a 100 percent tariff on imported semiconductor chips. India, Southeast Asia, and other key sourcing regions are navigating new tariff rules and trade agreements, with mixed results.

And in Europe, a major new sustainability initiative is underway. The European Commission has opened public consultations on the long-awaited Circular Economy Act, and our team is gathering member feedback to help shape the future of circular design policy.

The Global Advocacy Report will be taking a break for the rest of August, so we’ll see you in September. Stay tuned to your email inbox and our social media accounts for any news in the meantime, and let us know if you have any questions or concerns.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- New Tariffs Begin Reshaping Global Electronics Trade Landscape

QUOTE OF THE WEEK

- John Mitchell: Interdependence is Key to Resilient Supply Chains

UNITED STATES

- Copper Tariffs Finalized, Sparking Industry Backlash

ASIA

- U.S. Imposes New Tariff on Indian Imports Amid Geopolitical Tensions

- Southeast Asia Electronics Hubs Adjust to New U.S. Tariff Landscape

ENVIRONMENT AND SUSTAINABILITY

- European Commission Opens Consultation on Circular Economy Act

OTHER HEADLINES IN THE NEWS

- Reuters | Malaysia agrees to boost tech, LNG purchases from U.S. as part of trade deal

- Defense News | Technology, not geography, will grant global power in the 21st century

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

New Tariffs Begin Reshaping Global Electronics Trade Landscape: A range of new U.S. tariffs were imposed last Friday, August 1, with others following or delayed in the days since. A revised set of country-specific “reciprocal tariffs” went into effect yesterday, August 7, ranging from 10 to 41 percent, as reported by Politico. While most of the new agreements include baseline tariffs around 15 percent, they at least temporarily reduce the threat of even higher duties and provide short-term clarity for electronics manufacturers navigating a volatile policy environment.

President Trump this week signaled plans to impose a 100 percent tariff on imported semiconductor chips. He stated that companies investing in U.S.-based manufacturing may be eligible for exemptions from this forthcoming measure.

The Global Electronics Association views these developments in the context of its recent report on international trade flows in the electronics industry. A key conclusion was that to remain a major electronics producer, any country including the United States must also remain a major importer of specialized inputs. Trade relationships with countries supplying semiconductors, PCBs, laminates, and raw materials are not just economic concerns, they are essential to sustaining domestic electronics manufacturing, innovation, and national security.

The Association continues to urge officials to exempt critical inputs and is working with member companies to understand and prepare for the evolving landscape. Watch our social media accounts and Trade Policy web page for more details as they emerge. Contact: Chris Mitchell

|

|

“We really are a global industry. There is no one country that has the capability to build everything within their borders. I don’t care whether it’s the U.S. or China or wherever you look around the world. So there really needs to be strategic interdependence to make sure that the supply chain is resilient — and that is the challenge we’ve been facing.”

— Dr. John W. Mitchell, President and CEO of the Global Electronics Association, in a Nasdaq TradeTalks interview this week

|

Copper Tariffs Finalized, Sparking Industry Backlash: Last week, U.S. President Donald Trump’s 50 percent tariff on semi-finished copper products and copper-intensive derivatives went into effect. The Global Electronics Association issued a statement that says our industry is “disappointed” by the action, which “will hit U.S. printed circuit board (PCB) fabricators especially hard. … With no scalable domestic supply, U.S. electronics manufacturers will face higher costs, delay investments, and potentially even cut jobs. … This move directly undercuts President Trump’s goal of rebuilding American manufacturing and promoting American exports in strategic sectors.”

Also, in a recent meeting with White House officials, the Global Electronics Association urged policymakers to exempt electronics-grade copper inputs, and we presented the results of our survey of U.S. board fabricators and EMS firms on the potential impacts. Check out this Industry Intelligence Brief from the Global Electronics Association for the complete analysis. Companies should assess their exposure and consider strategies including supply diversification, increased recycling, and potential material substitutions. Contact: Chris Mitchell

|

U.S. Imposes New Tariff on Indian Imports Amid Geopolitical Tensions: This week, U.S. President Donald Trump signed an executive order imposing an additional 25 percent tariff on certain imports from India, citing evidence that India is “directly or indirectly importing oil from the Russian Federation.” The new tariff will take effect on August 27, with exemptions for in-transit goods that are loaded prior to that date and entered for consumption before September 17. The action adds to the 25 percent reciprocal tariff imposed on Indian goods earlier this month and compounds existing Section 232 duties on steel, aluminum, and copper.

Electronics products are largely exempt, although companies are advised to confirm applicability based on product classification. The tariff announcement comes as U.S.-India bilateral trade talks remain ongoing, with both sides expressing cautious optimism despite rising tensions. The Global Electronics Association is closely monitoring these developments and will provide updates as implementation details become available. Contact: Gaurab Majumdar

Southeast Asia Electronics Hubs Adjust to New U.S. Tariff Landscape: Electronics manufacturers in Southeast Asia are adjusting to evolving U.S. trade measures that took effect over the past two weeks. As reported by Vietnam Economic Times, the United States has officially lowered tariffs on Vietnamese imports to 20 percent under a new bilateral agreement announced this week. The deal includes provisions aimed at reducing transshipment of goods from third countries and allows the U.S. to impose a 40 percent tariff on any items found to be rerouted through Vietnam to avoid duties. The agreement is expected to preserve market access for Vietnamese electronics exporters while adding compliance scrutiny.

Meanwhile, The Nation Thailand reports that Thai officials are voicing concern over broader U.S. tariff changes and are seeking exemptions for key exports, including electronics components. According to Thai Commerce Ministry officials cited in the article, the country is at risk of losing competitiveness in sectors like printed circuit board assembly (PCBA) and semiconductors if higher U.S. duties are extended beyond current levels. Talks between U.S. and Thai trade officials are ongoing. The Global Electronics Association continues to track tariff policy developments across Southeast Asia, recognizing the region’s growing role as a production base for semiconductors, PCBs, and other critical inputs. Contact: Gaurab Majumdar

|

European Commission Opens Consultation on Circular Economy Act: The European Commission has officially launched its public consultation and call-for-evidence for the forthcoming Circular Economy Act, expected in late 2026. Released on August 1, the initiative marks one of the EU’s most comprehensive sustainability efforts to date and will remain open through November 6, 2025. The consultation includes roughly 30 questions, addressing challenges in e-waste management, barriers to circular business models, supply and demand for secondary raw materials, and strategies to scale circular processes across the Single Market. The Global Electronics Association is coordinating feedback on behalf of its members and strongly encourages participation. This is a key opportunity to shape a smarter, more supportive framework for circular innovation, investment, and simplified cross-border compliance. Contact: Diana Radovan

|

|

The Global Electronics Association discusses U.S. Mexico trade talks. |

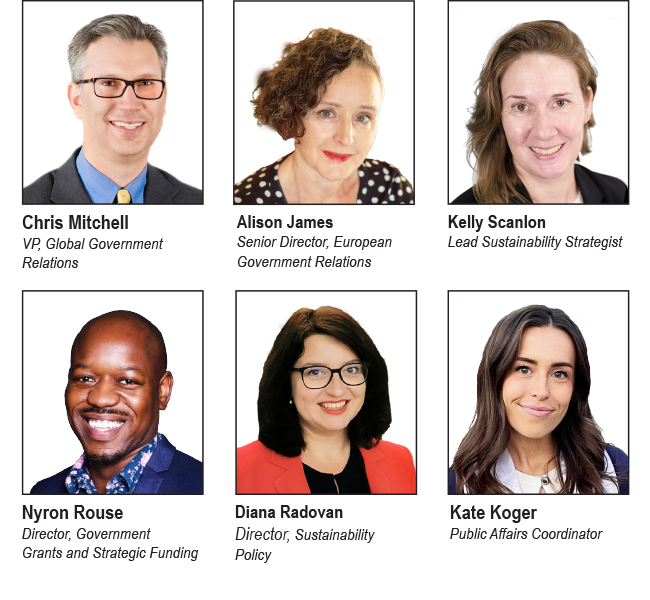

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |