|

Dear [Colleague]:

We are back this week with another look at the shifting government policy landscape for electronics manufacturing, including a record seven items in our SUSTAINABILITY AND ENVIRONMENT section.

In Latin America, sweeping new tariff proposals in Mexico are raising questions about future costs and sourcing strategies for the electronics industry. Meanwhile Brazil has launched a landmark sustainability taxonomy, and Chile is moving forward with its first National Critical Minerals Strategy.

Then over to Europe, where policymakers are seeking input on the long-awaited Circular Economy Act consultation, and updated lead exemptions are bringing new compliance timelines. The Global Electronics Association and other industry organizations are also calling for a more harmonized approach to substances of concern, and joining a consultation on the European Chips Act to ensure it keeps pace with technological and geopolitical change.

YOUR COMPANY’S INPUT NEEDED: If your company has any exposure to PFAS chemicals, please participate in our global PFAS use and alternatives survey via the link below.

Keep reading for your weekly five-minute update, and as always, please reach out with your input.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- Mexico Proposes Tariffs on Asian Electronics Imports

QUOTE OF THE WEEK

- Industry Leader Says U.S. Policy Volatility May Drive Companies Abroad

UNITED STATES

- Defense Microelectronics Budget Raises Concerns

- Apprenticeships Expand to Strengthen Electronics Workforce

EUROPE

- European Commission Launches Chips Act Consultation

ASIA

- Malaysia, India Expands Roles in Global Electronics Supply Chains

LATIN AMERICA

- Chile Advances National Critical Minerals Strategy

ENVIRONMENT AND SUSTAINABILITY

- Brazil Launches Sustainable Taxonomy Framework

- Association Supports Industry Call on Substances of Concern

- Input Needed for EU Circular Economy Act Consultation

- European Commission Extends Lead Exemptions for Electronics

- Europe Adopts Circular Economy Rules for Vehicles

- Association Joins Call on U.S. Congress to Revise TSCA

- Your Input Needed: Global Survey on PFAS Use and Alternatives in Electronics

OTHER HEADLINES IN THE NEWS

- AP News | Attorney says detained Korean Hyundai workers had special skills for short-term jobs

- Reuters | US critical minerals list expands ahead of possible tariffs

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

Mexico Proposes Tariffs on Asian Electronics Imports: This week, Mexican President Claudia Sheinbaum proposed new tariffs on 1,371 product categories from countries that do not have free trade agreements with Mexico, including China. According to Mexico News Daily, the proposed tariffs would range from 10 percent to 50 percent and cover inputs such as plastics, auto parts, and electronics components. At the same time, Mexico is also preparing to raise tariffs on imported vehicles from China and other Asian nations, with rates increasing from 20 percent to as high as 50 percent, as reported by Transport Topics.

For electronics manufacturing, the measures could drive up costs for imports of circuit boards, connectors, and other critical parts used in assembly. The policy could incentivize nearshoring of production within North America, while also creating ripple effects in global supply chains as companies reassess sourcing and investment strategies. The Global Electronics Association is monitoring the situation and will engage with members on potential impacts to the electronics ecosystem. Contact: Lorena Villanueva

|

|

“Companies need consistency to make plans and move forward. They’re moving to other countries because they’ll give us a 10-year plan and they’ll follow it. We have a government in this country that changes every four years, and they tend to undo everything that happened in the previous four years. That’s not a very reliable environment in which to build.”

— Dr. John W. Mitchell, President and CEO of the Global Electronics Association, speaking at a roundtable this week at Brainstorm Tech in Park City, Utah

|

Defense Microelectronics Budget Raises Concerns: In a recent column for I-Connect007, Shane Whiteside, President and CEO of Summit Interconnect, raised concerns that the fiscal year 2026 U.S. defense budget includes no dedicated line item for microelectronics under the Defense Production Act. Whiteside warned, “In a world of peer threats and urgent transformation, having secure, trusted, and reliable microelectronics is non-negotiable. Nothing in the current American arsenal flies, floats, or fights without a technology stack that includes a semiconductor, an integrated circuit substrate, and a printed circuit board.” Ensuring adequate funding for microelectronics is not only a national security priority but also a driver of industry resilience and innovation. Contact: Chris Mitchell

Apprenticeships Expand to Strengthen Electronics Workforce: Against the backdrop of U.S. President Donald Trump’s recent executive order setting a goal of 1 million new active apprenticeships, manufacturers are finding ew ways to build the workforce they need. As recently reported by the Tampa Bay Times, Mack Technologies piloted its first Surface Mount/Circuit Board Technician apprenticeship in 2024 and has since expanded the program in partnership with the Global Electronics Association. The company reports that 93 percent of graduates remain employed, helping to reduce turnover and improve efficiency. The Global Electronics Association has developed our apprenticeship programs to help member companies implement this model, providing both on-the-job training and industry-recognized certifications. Learn more on our Apprenticeships web page.

|

European Commission Launches Chips Act Consultation: The European Commission has opened a public consultation and call for evidence on the evaluation and review of the European Chips Act. The process aims to assess whether the Act remains fit for purpose amid shifting market conditions, rapid technological advances, and evolving geopolitical realities. It also seeks input on how the framework could be better adapted to support Europe’s semiconductor ecosystem in the years ahead. The consultation is open until November 28. The Global Electronics Association will submit a response reflecting feedback from the European ecosystem and the association’s Industry Call to Action for a resilient electronics sector. Contact: Alison James

|

Malaysia, India Expand Roles in Global Electronics Supply Chains: Malaysia and India are accelerating their efforts to become regional hubs for high-tech manufacturing.

As reported by Business Today Malaysia, the government is targeting new markets to diversify semiconductor exports beyond traditional destinations while strengthening industrial partnerships to expand capacity. Recent initiatives include the launch of the Electronics and Semiconductor Transformation Initiative (ETSI), which aims to bolster Malaysia’s role in advanced chip packaging and systems integration, and a strategic agreement between the Malaysian Investment Development Authority, Kulim Technology Park, and Hong Leong Bank to accelerate high-tech growth.

For the global electronics industry, Malaysia’s growth could reshape regional dynamics by creating new nodes of production and export diversification.

Meanwhile, in India at the 2025 Semicon India conference, the country unveiled its first domestically produced chip under the “Made in Bharat” initiative. According to a recent article in Communications Today, progress is due in part to $18 billion in incentives the government has provided to build chips locally. As reported by the Economic Times, India has made as much progress in two years as it took the United States and China to make in 10 years in their early semiconductor efforts.

For global electronics manufacturers, India’s rise presents both opportunities and challenges. Expanded domestic capacity could diversify supply chains and support global demand, while rapid consumption growth may further tighten markets for critical inputs. Contact: Gaurab Majumdar

|

Chile Advances National Critical Minerals Strategy: The Global Electronics Association has learned that the Government of Chile has completed the drafting stage of its first National Critical Minerals Strategy, which will cover rare earth minerals among other resources. A public consultation on the draft is expected to begin in September. Chile has the world's largest reserves of copper, lithium and rhenium, as well as vast reserves of boron, molybdenum, silver, and potassium as Bnamericas reported in April in an overview of the minerals strategy review. All of these minerals are used to various extents in electronics products. The Global Electronics Association will continue to monitor developments and provide updates on this emerging policy. Contact: Diana Radovan

|

Brazil Launches Sustainable Taxonomy Framework: On August 25, Brazil approved the final technical handbooks for its Sustainable Taxonomy (TSB), a framework that sets legal parameters for which activities can be classified as “sustainable.” According to a new blog from the Global Electronics Association, the first edition spans eight sectors, including manufacturing, extractives, energy, water and waste management, construction, transport, and telecommunications. Official publication of the handbooks is expected in September, with phased implementation starting with large firms and financial institutions.

Brazil’s approach stands out globally for several reasons. It prioritizes both climate change mitigation and adaptation; includes social dimensions such as gender and race; and is the first taxonomy to cover mining and extractive industries, preceding even the EU.

For electronics manufacturers, alignment with the taxonomy may become increasingly important as financing and investment decisions begin to reference these criteria. Future updates are expected to extend coverage to critical minerals, vehicles, the bioeconomy, and circular economy activities. Contact: Diana Radovan

Association Supports Industry Call on Substances of Concern: The Global Electronics Association has joined more than 30 industry groups in urging European policymakers to adopt a harmonized and workable approach to the “Substances of Concern” (SoC) concept, as part of the EU’s initiative to simplify environmental legislation. The joint letter was submitted in response to the consultation on simplification of administrative burdens in environmental legislation, which closed on September 10. According to the letter, the current use of the concept across multiple EU regulations is inconsistent and creates confusion for companies. The signatories call for a targeted and consistent definition of substances of concern, the avoidance of duplicate reporting requirements, and stronger regulatory coherence. The letter also recommends removing the SoC concept from the Ecodesign for Sustainable Products Regulation and other legal texts that reference it, proposing instead that information requirements be aligned with the existing REACH candidate list, supported by scientific hazard classification, risk assessment, and stakeholder engagement. Contact: Diana Radovan

Input Needed for EU Circular Economy Act Consultation: On August 1, the European Commission launched its long-anticipated public consultation and call-for-evidence for the upcoming Circular Economy Act, expected in late 2026. The consultation runs through November 6 and includes approximately 30 questions covering views on the circular economy, challenges and opportunities in managing e-waste, barriers to circular business models in the Single Market, supply and demand for secondary raw materials, and ways to strengthen waste management and circular processes. This is a key opportunity to help shape one of the EU’s most significant sustainability initiatives, with potential impacts on innovation, investment, and cross-border compliance. The Global Electronics Association is coordinating feedback on behalf of members and especially welcomes input from end-of-life and end-of-use companies in Europe at this stage. Contact: Diana Radovan

European Commission Extends Lead Exemptions for Electronics: The European Commission has approved updated rules that extend the timeline for certain exemptions for lead in electronics, specifically alloys, soldering, and ceramics,. Hazardous substances like lead in electrical and electronic equipment are generally restricted under EU rules, i.e. the RoHS directive, but temporary exemptions can be granted in specific, defined cases, i.e. when no reliable alternatives exist. The draft expiry date of 31st December 2026 has been pushed back to 30th June 2027. Other exemptions retain their expiry date of December 31, 2027. Companies in scope must apply for renewals by late 2025 or mid-2026, on a case-by-case basis. The cross-industry RoHS Umbrella Project groups working on renewal applications will rejoin soon. Contact: Diana Radovan

Europe Adopts Circular Economy Rules for Vehicles: According to a blog published this week by the Global Electronics Association, the European Union has adopted new rules that embed reuse, recycling, and resource efficiency into vehicle design and end-of-life management. The legislation requires easier removal of parts and components for reuse, recycling, remanufacturing, or refurbishing. Within six years, at least 20 percent of plastics in vehicles must be recycled content, rising to 25 percent within 10 years, with future targets expected for steel and aluminum. Manufacturers will assume extended producer responsibility for collecting and treating end-of-life vehicles. The rules also tighten distinctions between used and end-of-life vehicles and restrict exports of the latter outside the EU. For electronics manufacturers supplying the automotive sector, the policy signals growing demand for recyclable materials, design for disassembly, and transparent end-of-life practices across complex supply chains. Contact: Diana Radovan

Association Joins Call on U.S. Congress to Revise TSCA to Support Industry: In August, the U.S. Environmental Protection Agency (EPA) submitted a draft proposed rule for White House review, intended to replace the previous framework for evaluating existing chemicals under the Toxic Substances Control Act (TSCA). The revised rule will set procedures for chemical assessments that directly affect manufacturers across multiple sectors, including electronics. In a parallel effort, the Global Electronics Association joined more than 100 industry associations in calling on Congress to implement pragmatic changes to the TSCA framework. The letter emphasizes the need for a regulatory system that balances human health and environmental protection with the supply chain and innovation requirements of U.S. manufacturers. Contact: Diana Radovan

Your Input Needed: Global Survey on PFAS Use and Alternatives in Electronics: The Global Electronics Association has launched a global PFAS use and alternatives survey aimed at collecting industry input for European Chemicals Agency (ECHA) committee meetings (RAC and SEAC, in 2025) and public 2-month consultation on the SEAC draft opinion (in the first half of 2026). The agency has published an updated PFAS Restriction Background Document, Scientific Evaluation Status, and a process update with timelines. Survey findings will also shape the Association’s upcoming global PFAS position paper, due in October 2025. Members are encouraged to share how PFAS are used in their products, what viable PFAS alternatives are available, and what policymakers in different regions should prioritize when making PFAS-related restriction decisions affecting the electronics supply chain. Contact: Diana Radovan

|

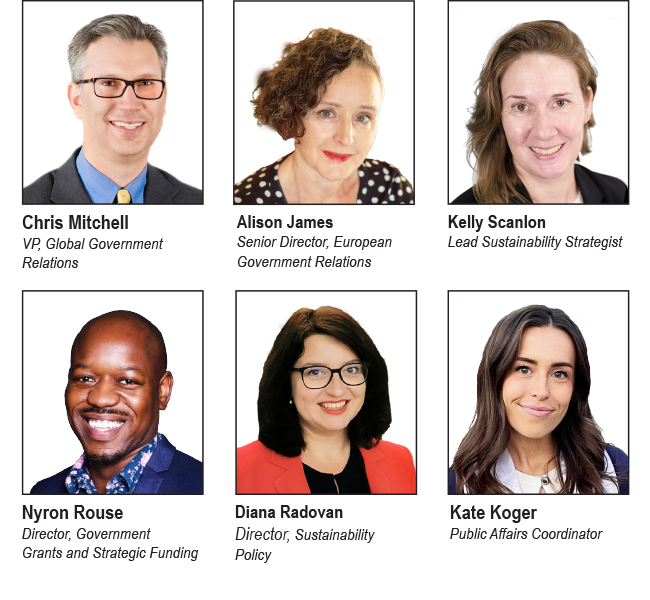

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |