|

Dear [Colleague]:

Electronics were once again making global headlines this week. At the forefront of this, tensions between the United States and China deepened with fresh moves on semiconductors and AI chips, reminding us just how much technology shapes the broader economic relationship between the world’s two largest markets.

Across Asia, Thailand is pitching new plans to expand its semiconductor role, while Vietnam continues to attract large-scale, high-tech investments that cement its position as a growing hub in global supply chains.

On the sustainability front, U.S. regulators are pushing forward on chemical reviews that could influence electronics production for years to come. The U.S. EPA opened a new consultation on the chemical D4, and the White House began reviewing potential changes to PFAS reporting mandates. Next week, we’ll be reporting from our first-ever Climate Week NYC event. Details below.

And in Europe, a new report from our team discusses the new transatlantic tariff agreement and its impacts on our industry in Europe and beyond.

There’s a lot to watch, and a lot at stake. Dive in for your weekly five-minute update, and let us know how these developments are impacting your business.

Next week, we’ll be reporting from our first-ever Climate Week NYC event. Details below.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- China-U.S. Tensions Escalate Over Semiconductors and AI Chips

QUOTE OF THE WEEK

- Global Trade Turmoil Cries Out for Your Advocacy Engagement

EUROPE

- New Report Eyes Industry Impact of U.S.-EU Tariff Agreement

- European Commission Launches Chips Act Consultation

ASIA

- Thailand Seeks to Expand Semiconductor Role with U.S. Roadshow

- Vietnam Sees Surge in Manufacturing Investment with Electronics at the Forefront

LATIN AMERICA

- Mexico Proposes Tariffs on Asian Electronics Imports

- Chile Advances National Critical Minerals Strategy

- Brazil Launches Sustainable Taxonomy Framework

ENVIRONMENT AND SUSTAINABILITY

- U.S. EPA Opens Consultation on D4 Risk under TSCA

- U.S. EPA Advances Proposal To Ease PFAS Reporting Mandates

- Association Joins Industry Call on U.S. Congress to Revise TSCA

- European Chemicals Agency Provides Updates on PFAS Plans

EVENTS

- Power On: Climate & Circularity in Electronics – Climate Week NYC

OTHER HEADLINES IN THE NEWS

- Economic Times | India’s IT eyes chip, electronics foray to glide over growth bumps

- The Hill | Trump says he doesn’t want to ‘frighten off’ foreign investment after backlash to Hyundai raid

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

China-U.S. Tensions Escalate Over Semiconductors and AI Chips: This week saw fresh turbulence in the China-U.S. technology relationship, with semiconductors and electronics at the center of the dispute. According to CNBC, Beijing has barred domestic tech companies from purchasing Nvidia’s H20 and RTX Pro 6000D AI chips, effectively freezing the firm out of the Chinese market. Analysts said the move reflects growing confidence in China’s domestic chipmakers and may serve as leverage in broader trade negotiations.

Meanwhile, China’s Ministry of Commerce launched new investigations into U.S. semiconductors, as reported by the Associated Press. One probe targets alleged dumping of analog chips made by Texas Instruments and Analog Devices, while another reviews U.S. government rules on integrated circuits and export restrictions. The timing comes just before U.S.-China trade talks in Madrid.

On the U.S. side, lawmakers are also weighing new measures. Forbes reported that the Senate draft of the annual National Defense Authorization Act includes the bipartisan GAIN AI Act, which would impose licensing requirements on advanced chips and give American buyers first rights to supplies destined for countries of concern, including China. The proposal has drawn pushback from industry, with companies such as Nvidia and trade groups warning against stricter limits.

For global electronics manufacturers, the developments highlight how regulatory actions in both countries could reshape chip availability, trade flows, and investment strategies. For additional perspective, see the Global Electronics Association’s recent international trade flows report. Contact: Chris Mitchell

|

|

“Whether you're a PCB fabricator in Texas, an EMS provider in California, or a component supplier in Japan, your operations are directly shaped by your national government’s trade policies. Your voice carries weight with policymakers, especially when paired with on-the-ground data and firsthand insight.”

— Chris Mitchell, Vice President of Global Government Relations for the Global Electronics Association, calling for greater company engagement in advocacy in his recent Government Circuit column in I-Connect007

|

New Report on Tariffs and Europe’s Electronics Industry: The Global Electronics Association published a new report this week on the impacts of the recently concluded U.S.-EU tariff agreement. Beginning August 1, most European electronics exports to the United States are subject to a unified 15 percent tariff, which the paper estimates will add billions in annual duties. The tariffs also will raise costs for U.S. importers and consumers while disadvantaging European producers relative to competitors in Mexico and Asia. Beyond the direct cost effects, the analysis highlights how this agreement reflects a broader departure from the World Trade Organization’s “Most Favored Nation” principle, which requires WTO members to extend the same trade advantages to all nations with MFN status, replacing it with a more fragmented global trade landscape. The pact compounds several existing challenges for Europe’s electronics industry, including high energy costs, regulatory burdens, and supply chain vulnerabilities, and it underscores the need for a coordinated European strategy across the electronics value chain. Contact: Alison James

European Commission Launches Chips Act Consultation: The European Commission recently opened a public consultation and call for evidence for a review of the European Chips Act. The process aims to assess whether the Act remains fit for purpose amid shifting market conditions, rapid technological advances, and evolving geopolitical realities. It also seeks input on how the framework could be better adapted to support Europe’s semiconductor ecosystem in the years ahead. The consultation will be open until November 28. The Global Electronics Association will submit a response reflecting feedback from the European ecosystem and our Industry Call to Action for a resilient electronics sector. Contact: Alison James

|

Thailand Seeks to Expand Semiconductor Role with U.S. Roadshow: Thailand is stepping up efforts to move up the electronics value chain. According to The Nation Thailand, the country’s Board of Investment (BOI) and Ministry of Higher Education, Science, Research and Innovation held a U.S. roadshow this month to promote upstream semiconductor investment. The delegation met with major global chip companies including Intel, NXP, and Synopsys, while also signing a memorandum of understanding with Arizona State University to train 80,000 semiconductor professionals within five years. Officials said the initiative is part of Thailand’s long-term plan to attract 500 billion baht (US$13.6 billion) in foreign direct investment and establish a more comprehensive domestic semiconductor ecosystem. For electronics manufacturers, these efforts highlight the broader regional competition to secure new chip investment, workforce development, and supply chain integration. Contact: Gaurab Majumdar

Vietnam Sees Surge in Manufacturing Investment with Electronics at the Forefront: Vietnam’s manufacturing sector continues to dominate foreign investment flows, with electronics playing a central role. According to Vietnam News, the industry has attracted a cumulative US$320.7 billion in foreign capital, equal to more than 61 percent of the country’s total registered investment. In August 2025 alone, foreign-invested projects in the sector totaled US$1.6 billion, led by a US$300 million smartphone manufacturing project in Bắc Ninh and a US$207 million transformer production facility in Hải Phòng. Additional expansions, including a US$200 million investment increase in synthetic fiber production by Hong Kong–based Hailide Fibers, further underscore the sector’s momentum. Experts note that Vietnam’s ability to draw large-scale, high-tech projects in electronics and semiconductors reflects its growing role as a key link in global supply chains. At the same time, policymakers caution that heavy reliance on electronics manufacturing could expose the economy to risks, and they are considering reforms in infrastructure, workforce development, and administrative processes to sustain long-term competitiveness. Contact: Gaurab Majumdar

|

Mexico Proposes Tariffs on Asian Electronics Imports: Last week, Mexican President Claudia Sheinbaum proposed new tariffs on 1,371 product categories from countries that do not have free trade agreements with Mexico, including China. According to Mexico News Daily, the proposed tariffs would range from 10 percent to 50 percent and cover inputs such as plastics, auto parts, and electronics components. At the same time, Mexico is also preparing to raise tariffs on imported vehicles from China and other Asian nations, with rates increasing from 20 percent to as high as 50 percent, as reported by Transport Topics.

For electronics manufacturing, the measures could drive up costs for imports of circuit boards, connectors, and other critical parts used in assembly. The policy could incentivize nearshoring of production within North America, while also creating ripple effects in global supply chains as companies reassess sourcing and investment strategies. The Global Electronics Association is monitoring the situation and will engage with members on potential impacts to the electronics ecosystem. Contact: Lorena Villanueva

Chile Advances National Critical Minerals Strategy: The Global Electronics Association recently learned that the Government of Chile has completed the drafting stage of its first National Critical Minerals Strategy, which will cover rare earth minerals among other resources. A public consultation on the draft is expected to begin this month. Chile has the world's largest reserves of copper, lithium and rhenium, as well as vast reserves of boron, molybdenum, silver, and potassium as Bnamericas reported in April in an overview of the minerals strategy review. All of these minerals are used to various extents in electronics products. The Global Electronics Association will continue to monitor developments and provide updates on this emerging policy. Contact: Diana Radovan

Brazil Launches Sustainable Taxonomy Framework: On August 25, Brazil approved the final technical handbooks for its Sustainable Taxonomy (TSB), a framework that sets legal parameters for which activities can be classified as “sustainable.” According to a new blog from the Global Electronics Association, the first edition spans eight sectors, including manufacturing, extractives, energy, water and waste management, construction, transport, and telecommunications. Official publication of the handbooks is expected in September, with phased implementation starting with large firms and financial institutions.

Brazil’s approach stands out globally for several reasons. It prioritizes both climate change mitigation and adaptation; includes social dimensions such as gender and race; and is the first taxonomy to cover mining and extractive industries, preceding even the EU. For electronics manufacturers, alignment with the taxonomy may become increasingly important as financing and investment decisions begin to reference these criteria. Future updates are expected to extend coverage to critical minerals, vehicles, the bioeconomy, and circular economy activities. Contact: Diana Radovan

|

U.S. EPA Opens Consultation on D4 Risk under TSCA: The U.S. Environmental Protection Agency (EPA) has released a draft risk evaluation for D4 (octamethylcyclotetrasiloxane) under the Toxic Substances Control Act (TSCA). According to the agency, the preliminary findings indicate that D4 poses an unreasonable risk to human health and the environment under certain conditions of use. D4, a cyclic silicone compound, is widely used in electronics, including in semiconductor manufacturing, where it often remains embedded in components and does not emit during use. The substance is already classified as a “substance of very high concern” (SVHC) by the European Chemicals Agency (ECHA) and is banned in EU personal care products due to persistence, bioaccumulation, and toxicity. EPA will accept public comments on the draft evaluation through November 17 via this docket, and it will convene a series of public meetings in the coming months. The Global Electronics Association is gathering member input to help shape industry feedback on the evaluation. Contact: Diana Radovan

U.S. EPA Advances Proposal To Ease PFAS Reporting Mandates: The U.S. Environmental Protection Agency (EPA) has submitted sent a proposal for review that would ease PFAS reporting requirements under the Toxic Substances Control Act (TSCA). The White House Office of Management and Budget (OMB) will review the proposal, which arose after a coalition of chemical companies argued the measure fails to align with the best reading of the toxics law. The rule currently requires companies to submit information about PFAS used in any year from 2011 until 2022. The OMB review typically takes 90 days. The Global Electronics Association will continue to monitor this development and keep members informed. Contact: Diana Radovan

Association Joins Industry Call on U.S. Congress to Revise TSCA: The Global Electronics Association joined more than 100 industry associations in calling on Congress to implement pragmatic changes to the TSCA framework. The letter emphasizes the need for a regulatory system that balances human health and environmental protection with the supply chain and innovation requirements of U.S. manufacturers. Read more about it here. Contact: Diana Radovan

European Chemicals Agency Provides Updates on PFAS Plans: The European Chemicals Agency (ECHA) has published an updated PFAS Restriction Background Document (not to be seen as final currently), Scientific Evaluation Status, and a process update with timelines. A public 2-month consultation regarding the SEAC (the Socio-Economic Committee of ECHA) draft opinion is expected in spring in a questionnaire format, for which the Association will consolidate member feedback. To support consultation preparation, ECHA will hold an online information session on 30 October 2025. Additionally, ECHA will confirm the exact starting date of the consultation in March 2026. The Association will have a face-to-face informal meeting with SEAC in Brussels in mid-October. Members are invited to send their questions for the SEAC to our team by 24 September 2025 EOD. Members are encouraged to already start considering, ahead of the consultation window: potential impacts of restricting PFAS in the electronics sector (e.g., repercussions of non-use scenarios such as no impact, closure of operations, relocation, or substitution of PFAS); availability and feasibility of alternatives; missed uses and derogations in the current draft background document, if relevant to socio-economic aspects. Contact: Diana Radovan

|

Power On: Climate & Circularity in Electronics – Climate Week NYC: On September 24, the Global Electronics Association will host its first-ever Climate Week NYC event. You can register for the event panel here or reserve your lunch spot here. The program includes a networking lunch followed by a panel discussion featuring sustainability leaders from Jabil, Flex, Panasonic, and the Association. The conversation will focus on practical circularity challenges and innovations that drive efficiency and regulatory compliance. The event will take place at Chelsea Walls in partnership with Anthesis Group. Contact: Kelly Scanlon

|

Global Electronics Association President and CEO John W. Mitchell discusses AI. |

|

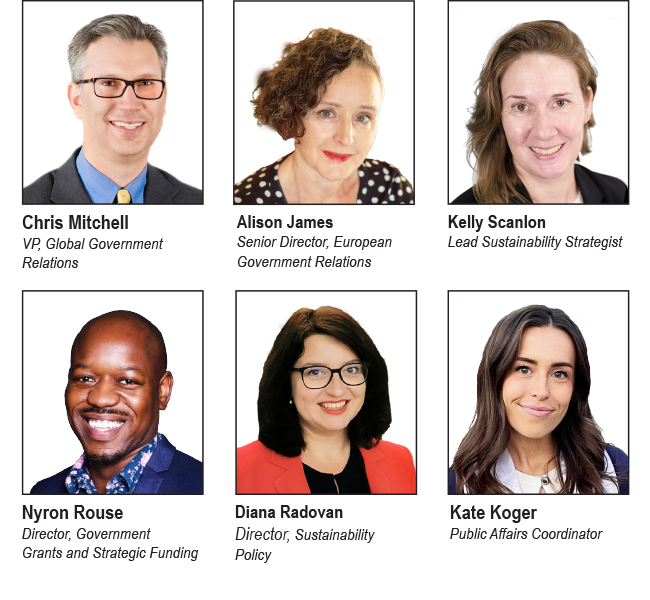

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |