|

Dear [Colleague]:

After a short August break, we’re back with your weekly Global Advocacy Report and plenty of developments to catch up on.

On the global trade front, a U.S. expansion of its metals tariffs is creating new ripple effects across supply chains. But a federal appeals court ruled that the reasoning behind much of President Trump’s tariffs agenda is unlawful. The Supreme Court may settle the issue this fall.

Also in the USA, our industry continues to raise questions around adequate funding for defense microelectronics. On the workforce front, we’re seeing encouraging momentum as apprenticeship programs gain traction.

Abroad, both Malaysia and India are making bold moves in semiconductors, with potential to reshape how and where electronics are designed and manufactured.

Sustainability is also at stake amid shifting U.S.-EU trade requirements; new activity by the U.S. EPA on toxic chemicals; and an effort by the Global Electronics Association to gather data on PFAS usage in advance of key consultations in Europe. Each of these developments will carry long-term implications for how our industry balances innovation with regulation.

Keep reading for this week’s update, and as always, please reach out with any questions or input.

Chris Mitchell

Vice President, Global Government Relations

The Headlines at a Glance:

TOP NEWS OF THE WEEK

- Appeals Court Rejects Trump’s “Emergency” Tariffs

- Metals Tariff Expansion Puts Pressure on Electronics Supply Chains

QUOTE OF THE WEEK

- Building Talent in Electronics Requires Diverse Pathways to Careers

UNITED STATES

- Defense Microelectronics Budget Raises Concerns

- Apprenticeships Expand to Strengthen Electronics Workforce

ASIA

- Malaysia Expands Role in Global Electronics Supply Chains

- India Accelerates Semiconductor and Electronics Growth

ENVIRONMENT AND SUSTAINABILITY

- US-EU Trade Framework Flags ESG Compliance Reviews

- EPA Advances TSCA Framework Review

- Your Input Is Needed on Global Survey on PFAS Use and Alternatives in Electronics

OTHER HEADLINES IN THE NEWS

- The Nation | New Incentives to Transform Thailand into an EV Export Hub

- The Washington Times | Intel and the future of free market economics

HELP US SPREAD THE WORD ON SOCIAL MEDIA

KEEP IN TOUCH WITH US

|

Appeals Court Rejects Trump’s “Emergency” Tariffs: Most of U.S. President Donald Trump's sweeping global tariffs are unlawful, a federal appeals court ruled, which could deal a significant blow to a core element of the president's economic policy agenda. Despite the ruling, the court let the tariffs remain in place through mid-October to allow the Trump administration to appeal to the Supreme Court. Analysts said if the ruling is upheld, the United States may have to return nearly $100 billion in duties collected so far, The Times of London reported. Sen. James Lankford (R-OK) told NBC's "Meet the Press" that the ongoing tariff drama is disruptive to business and needs to be resolved one way or another. Contact: Chris Mitchell

Metals Tariff Expansion Puts Pressure on Electronics Supply Chains: On August 18, the Trump administration expanded its 50 percent tariffs on steel and aluminum to more than 400 additional product categories, as reported by CNBC. The new list now covers items ranging from auto parts and machinery to specialty chemicals and construction materials.

The category expansion has significant implications for electronics manufacturers. Steel and aluminum are used in many kinds of manufacturing equipment, enclosures, heat sinks, and other components critical to production. According to a fresh analysis in our Global Perspectives blog series, companies in the United States are already facing cost pressures, reduced customer demand, and operational inefficiencies linked to tariffs on key materials. Many firms worldwide are reevaluating supply chains, carrying more inventory, and slowing hiring as they brace for ongoing volatility.

The Global Electronics Association views these issues in the context of our recent report on international trade flows in the electronics industry, which concluded that electronics supply chains are more globally integrated than any other industry, surpassing even the automotive sector in cross-border complexity. We continue to urge officials to exempt critical inputs from the tariffs and take a more comprehensive approach to building up domestic manufacturing. We are also working with member companies to understand and prepare for the evolving landscape. Watch our social media accounts and Trade Policy web page for more details as they emerge. Contact: Chris Mitchell

|

|

“The electronics industry encompasses a wide range of roles, which require different levels of education, training or experience. Some roles are well-suited to on-the-job learning, which means that with relatively limited classroom training, workers can learn enough to begin working and then can continue to learn while they earn a paycheck. Other roles may require either a four-year degree, or a combination of education and on-the-job learning to acquire a broader set of skills.”

— Dr. John W. Mitchell, President and CEO of the Global Electronics Association, emphasizing the need for diverse career pathways in the electronics workforce in a recent Forbes article

|

Defense Microelectronics Budget Raises Concerns: In a recent column for I-Connect007, Shane Whiteside, President and CEO of Summit Interconnect, raised concerns that the fiscal year 2026 U.S. defense budget includes no dedicated line item for microelectronics under the Defense Production Act. Whiteside warned that current funding is too limited to meet growing demand for secure and reliable defense technologies. “In a world of peer threats and urgent transformation, having secure, trusted, and reliable microelectronics is non-negotiable. Nothing in the current American arsenal flies, floats, or fights without a technology stack that includes a semiconductor, an integrated circuit substrate, and a printed circuit board.”

For the global electronics industry, this debate underscores the critical role of more robust and secure domestic and allied supply chains. Electronics manufacturers are directly affected by government decisions that shape demand for and output of advanced PCBs, semiconductors, and related components. Ensuring adequate funding for microelectronics is not only a national security priority but also a driver of industry resilience and innovation. Contact: Chris Mitchell

Apprenticeships Expand to Strengthen Electronics Workforce: Against the backdrop of U.S. President Donald Trump’s recent executive order setting a goal of 1 million new active apprenticeships, manufacturers are finding new ways to build the workforce they need. As reported by the Tampa Bay Times, Mack Technologies piloted its first Surface Mount/Circuit Board Technician apprenticeship in 2024 and has since expanded the program in partnership with the Global Electronics Association. The company reports that 93 percent of graduates remain employed, helping to reduce turnover and improve efficiency.

Apprenticeships are proving to be a practical solution to the industry’s workforce challenges. More than two-thirds of electronics manufacturers report difficulty hiring and retaining skilled workers, and by 2031, the U.S. manufacturing sector is projected to have 2.1 million unfilled jobs. Apprenticeship programs help close that gap by offering structured pathways into electronics careers while delivering strong returns on investment for employers. The Global Electronics Association has developed our apprenticeship programs to help member companies implement this model, providing both on-the-job training and industry-recognized certifications. Learn more on our Apprenticeships web page.

|

Malaysia Expands Role in Global Electronics Supply Chains: Malaysia is accelerating its efforts to become a regional hub for high-tech manufacturing. As reported by Business Today Malaysia, the government is targeting new markets to diversify semiconductor exports beyond traditional destinations while strengthening industrial partnerships to expand capacity. Recent initiatives include the launch of the Electronics and Semiconductor Transformation Initiative (ETSI), which aims to bolster Malaysia’s role in advanced chip packaging and systems integration, and a strategic agreement between the Malaysian Investment Development Authority, Kulim Technology Park, and Hong Leong Bank to accelerate high-tech growth. For the global electronics industry, Malaysia’s growth could reshape regional dynamics by creating new nodes of production and export diversification. These moves may help stabilize global supply chains, provide alternative sourcing options, and influence investment patterns across Asia-Pacific. At the same time, increased capacity in Malaysia could sharpen competition for talent and resources while reinforcing the country’s importance as a partner in semiconductor and electronics ecosystems. Contact: Gaurab Majumdar

India Accelerates Semiconductor and Electronics Growth: India’s electronics industry is gaining momentum, with recent milestones showing its growing role in global supply chains. This week, IT minister Ashwini Vaishnaw presented Prime Minister Narendra Modi with a showcase of chips made in India. At the 2025 Semicon India conference, the country unveiled its first domestically produced chip under the “Made in Bharat” initiative, marking a symbolic step toward reducing reliance on imports.

According to an article in Communications Today, the progress is due in part to the $18 billion in incentives that the government has provided to make chips locally. As reported by the Economic Times, India has made as much progress in two years as it took the United States and China to make in 10 years in their early development phases. Government-backed policies, including the next phase of the India Semiconductor Mission, are prioritizing investment in areas such as silicon carbide wafer manufacturing. At the same time, industry leaders project that India’s semiconductor consumption will rise to $100–120 billion by 2030, driven by growth in electronics, automotive, and clean energy applications, according to the Economic Times.

For global electronics manufacturers, India’s rise presents both opportunities and challenges. Expanded domestic capacity could diversify supply chains and support global demand, while rapid consumption growth may further tighten markets for critical inputs. How India balances domestic industrialization with international integration will be a key factor shaping global electronics trade in the years ahead. Contact: Gaurab Majumdar

|

US-EU Trade Framework Flags ESG Compliance Reviews: On August 21, the United States and the European Union announced a “Framework Agreement on Reciprocal, Fair, and Balanced Trade” that builds on their broader July deal. According to official communications, four of the agreement’s 19 terms address EU ESG and corporate sustainability reporting (CSR) requirements. The EU committed to review several sustainability policies to reduce administrative burdens and respond to specific U.S. concerns, including the EU Deforestation Regulation, the Carbon Border Adjustment Mechanism, the Corporate Sustainability Due Diligence Directive, the Corporate Sustainability Reporting Directive, and the Forced Labor Regulation. The practical implications remain unclear as the EU is already scaling back requirements of the above-mentioned policies, and further U.S.-EU discussions are expected. We expect more granularity to emerge in the coming weeks and months, and we will continue to update you on the changes. Contact: Diana Radovan

U.S. EPA Advances TSCA Framework Review: In August, the U.S. Environmental Protection Agency (EPA) submitted a draft proposed rule for White House review, intended to replace the previous framework for evaluating existing chemicals under the Toxic Substances Control Act (TSCA). The revised rule will set procedures for chemical assessments that directly affect manufacturers across multiple sectors, including electronics. In a parallel effort, the Global Electronics Associationned more than 80 industry associations in calling on Congress tomplement pragmatic, fit-for-business and environment changes to the TSCA framework. The letter emphasized the need for a regulatory system that balances human health and environmental protection with the supply chain and innovation requirements of U.S. electronics manufacturers. Contact: Diana Radovan

Your Input Is Needed on Global Survey on PFAS Use and Alternatives in Electronics: The Global Electronics Association has launched a global PFAS use and alternatives survey aimed at collecting industry input ahead of upcoming European Chemicals Agency (ECHA) committee meetings (in 2025) and consultation (in 2026). The agency has published an updated PFAS Restriction Background Document, Scientific Evaluation Status, and a process update with timelines. Your input will informscussions with ECHA’s Risk Assessment Committee and Socio-Economic Analysis Committees, and it will support preparation for the 2026 consultation on the SEAC draft opinion in the first half of 2026. Survey findings will also shape policy position papers and data-driven advocacy in other regions, including the United States. Members are encouraged to share how PFAS are used in their products, what alternatives are available, and what policymakers in different regions should prioritize when making PFAS-related restriction decisions affecting the electronics supply chain. Contact: Diana Radovan

|

Stat of the Week: The electronics industry drives over 20% of global trade. |

Sanjay Huprikar discusses the most pressing challenges in the global electronics industry. |

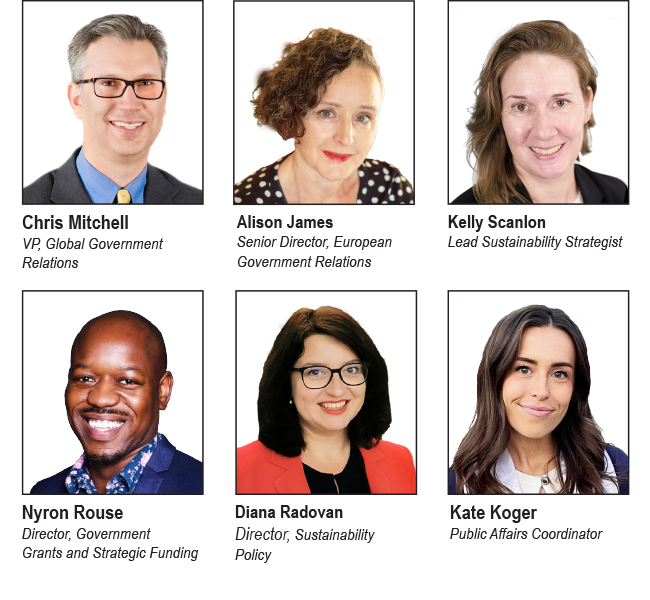

KEEP IN TOUCH WITH US Meet Our Government Relations Team: Whether it is engaging with policymakers in the Americas, Europe, or Asia, the Global Electronics Association Government Relations (GR) Team works to educate, inform, and influence policymakers on policies that affect our industry. Our success depends on active support and participation from attentive people like you!

Peruse our global Advocacy pages on electronics.org and follow the links to information about our work in North America, Europe, and Asia. Subscribe to the Global Advocacy Report: If you are a member of the Global Electronics Association, manage your e-mail preferences and opt in to receive all “Advocacy” updates. If you are not a member — or if you are not sure — please send a note to friends@electronics.org, and our staff will add you to the list. See prior editions of Global Advocacy Report. Please contact one of us via the links above if you have any questions or insights to share! |